To obtain a business permit in California, essential documents include a completed application form, proof of government-issued identification, and a valid business license. Applicants must also provide zoning clearance, tax registration certificates, and any industry-specific permits or certifications required by local authorities. Ensuring all paperwork is accurate and submitted on time streamlines the approval process for business operations.

What Documents are Necessary for a Business Permit in California?

| Number | Name | Description |

|---|---|---|

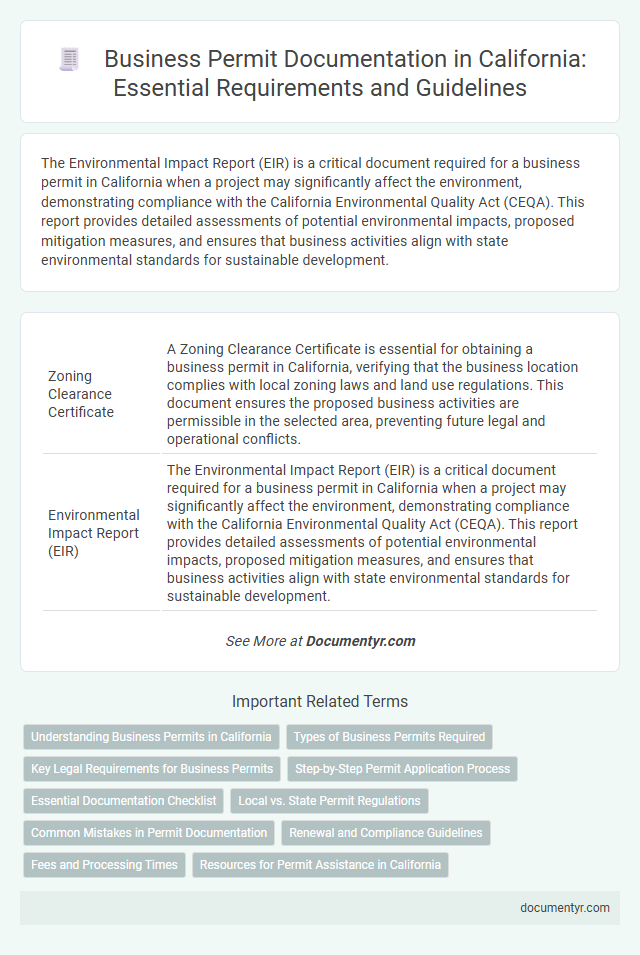

| 1 | Zoning Clearance Certificate | A Zoning Clearance Certificate is essential for obtaining a business permit in California, verifying that the business location complies with local zoning laws and land use regulations. This document ensures the proposed business activities are permissible in the selected area, preventing future legal and operational conflicts. |

| 2 | Environmental Impact Report (EIR) | The Environmental Impact Report (EIR) is a critical document required for a business permit in California when a project may significantly affect the environment, demonstrating compliance with the California Environmental Quality Act (CEQA). This report provides detailed assessments of potential environmental impacts, proposed mitigation measures, and ensures that business activities align with state environmental standards for sustainable development. |

| 3 | Seller’s Permit (CDTFA) | To obtain a business permit in California, securing a Seller's Permit from the California Department of Tax and Fee Administration (CDTFA) is essential for businesses engaged in selling tangible goods. This permit authorizes the collection of sales tax and requires documentation such as a completed CDTFA-401-B application, a valid ID, and proof of business location. |

| 4 | Fictitious Business Name Statement (FBN) | The Fictitious Business Name Statement (FBN) is a crucial document required for obtaining a business permit in California, especially when operating under a name different from the owner's legal name. This statement must be filed with the county clerk's office where the business is located and typically includes the business name, owner's name, address, and type of business. |

| 5 | California EDD Registration | California EDD registration requires submitting a completed DE 1 form along with proof of California Secretary of State registration for business permit applications. Valid identification, Federal Employer Identification Number (FEIN), and workers' compensation insurance details are essential documents to fulfill state employment regulations. |

| 6 | Cal/OSHA Safety Compliance Documentation | Cal/OSHA safety compliance documentation required for a California business permit includes a comprehensive Injury and Illness Prevention Program (IIPP), written safety and health plans, employee training records, and hazard communication programs. Employers must also maintain records of workplace inspections, injury logs (OSHA Form 300), and respiratory protection program documentation to demonstrate adherence to state and federal safety regulations. |

| 7 | Resale Certificate | A Resale Certificate is essential for obtaining a business permit in California as it enables businesses to purchase goods for resale without paying sales tax, ensuring compliance with the California Department of Tax and Fee Administration regulations. This certificate must be properly filled out and presented alongside other required documents such as a completed permit application, proof of identification, and a valid business license. |

| 8 | Certificate of Occupancy | A Certificate of Occupancy is essential for a business permit in California, verifying that the building complies with local zoning laws and safety codes. This document confirms the space is suitable for commercial use, ensuring legal operation and occupancy approval. |

| 9 | Waste Discharge Identification Number (WDID) | A Waste Discharge Identification Number (WDID) is a critical document required for obtaining a business permit in California, especially for operations involving waste discharge into surface or groundwater. This number, issued by the State Water Resources Control Board, ensures compliance with water quality regulations and must be submitted along with other permit application documents. |

| 10 | Sustainable Business Compliance Checklist | The Sustainable Business Compliance Checklist for a California business permit requires documents including a completed application form, proof of business registration, environmental impact assessments, waste management plans, energy efficiency certifications, and evidence of adherence to local sustainability ordinances. These documents ensure the business meets state regulations for sustainable operations and environmental responsibility. |

Understanding Business Permits in California

Obtaining a business permit in California requires specific documents to comply with local and state regulations. These documents verify your business's legitimacy and ensure adherence to zoning and safety standards.

Key documents include a completed application form, proof of business ownership, and a valid government-issued identification. You may also need to provide a health permit, zoning clearance, and a federal Employer Identification Number (EIN), depending on your business type.

Types of Business Permits Required

Obtaining a business permit in California requires submitting specific documents relevant to your business type and location. Understanding the types of business permits needed ensures smooth compliance with state and local regulations.

- General Business License - A standard permit issued by city or county authorities allowing you to legally operate within their jurisdiction.

- Health Permit - Required for businesses involved in food preparation, handling, or sale to ensure public safety standards are met.

- Zoning Permit - Confirms that your business location complies with local zoning laws and land use regulations.

Key Legal Requirements for Business Permits

Obtaining a business permit in California requires submitting specific documents to comply with state and local regulations. Key legal requirements include proof of business registration, such as a DBA (Doing Business As) or Articles of Incorporation.

Applicants must also provide a valid identification, federal Employer Identification Number (EIN), and necessary zoning clearance from local authorities. Additional permits or licenses may be required depending on the nature of the business and location within California.

Step-by-Step Permit Application Process

| Step | Required Documents | Description |

|---|---|---|

| 1. Business Name Registration | Fictitious Business Name Statement | Submit a Fictitious Business Name Statement to the county clerk's office if operating under a name other than your own. |

| 2. Business Location Verification | Proof of Address (Lease Agreement or Property Deed) | Provide documentation confirming the physical location of your business for zoning and compliance purposes. |

| 3. Business Structure Documentation | Articles of Incorporation, Partnership Agreement, or LLC Operating Agreement | Include official formation documents that establish your business entity type. |

| 4. Federal Employer Identification Number (EIN) | EIN Confirmation Letter from the IRS | Obtain an EIN for tax identification and reporting required by the permit application. |

| 5. State Licensing and Registration | California State Business License or Professional License | Show evidence of compliance with state-level licensing applicable to your industry. |

| 6. Health and Safety Permits | Health Department Approval or Specialized Certificates | Submit health permits if your business involves food, health care, or other regulated activities. |

| 7. Zoning Compliance | Zoning Permit or Land Use Approval | Verify that your business location adheres to local zoning laws. |

| 8. Permit Application Form | Completed Local Business Permit Application | Fill out and submit the official permit application form provided by the city or county authority. |

| 9. Payment of Fees | Proof of Payment (Receipt) | Provide receipts for any applicable application and permit fees as part of your submission. |

| 10. Additional Documentation (If Applicable) | Environmental Impact Reports, Fire Department Approval | Submit extra documentation if your business requires specific regulatory clearances. |

Essential Documentation Checklist

Obtaining a business permit in California requires submitting a set of essential documents to comply with state regulations. Your documentation must include a completed application form, proof of business registration, and identification such as a government-issued ID. Additional requirements often involve zoning clearance, tax identification numbers, and any industry-specific certifications necessary for legal operation.

Local vs. State Permit Regulations

Obtaining a business permit in California requires compliance with both local and state regulations. Understanding the distinct documentation needed at each level ensures proper authorization for your business operations.

- Local Permit Application - You must submit an application specific to the city or county where your business operates, which often includes a zoning clearance and local tax identification.

- State Business License - A state-level license may be necessary depending on the business type and industry, typically administered by the California Secretary of State or other state agencies.

- Supporting Identification Documents - Providing proof of identity, such as a government-issued ID, and business formation documents like articles of incorporation are commonly required for both local and state permits.

Common Mistakes in Permit Documentation

Securing a business permit in California requires essential documents such as a completed application form, proof of business registration, and a valid government-issued ID. Common mistakes include submitting incomplete applications, missing signatures, and failure to provide accurate business descriptions. You must ensure all documentation is thoroughly reviewed to avoid delays or rejections during the permit approval process.

Renewal and Compliance Guidelines

Renewing a business permit in California requires submitting specific documents to ensure compliance with local regulations. You must stay informed about renewal deadlines and necessary paperwork to avoid penalties.

- Current Business Permit - Required to verify your existing authorization for operation in California.

- Proof of Compliance - Demonstrates that your business meets state health, safety, and zoning regulations.

- Renewal Application Form - Completed and signed form submitted to the local permitting office.

Maintaining compliance through timely renewals and accurate documentation safeguards your business's legal standing and operational continuity.

Fees and Processing Times

Obtaining a business permit in California requires specific documents, including a completed application form, proof of identification, and a valid business license. Fees vary by location and type of business, typically ranging from $50 to several hundred dollars, with some permits requiring annual renewal fees.

Processing times depend on the issuing agency and can take from a few days to several weeks. Local city or county offices often provide expedited services for additional fees. It is essential to consult the specific jurisdiction's guidelines to understand exact fees and processing durations.

What Documents are Necessary for a Business Permit in California? Infographic