Home-based businesses require specific license documents to operate legally, including a business license, zoning permits, and home occupation permits. These documents ensure compliance with local regulations and verify that the business activities are permitted within residential areas. Securing the necessary licenses protects the business from fines and supports smooth operation within the community.

What License Documents Are Necessary for a Home-Based Business?

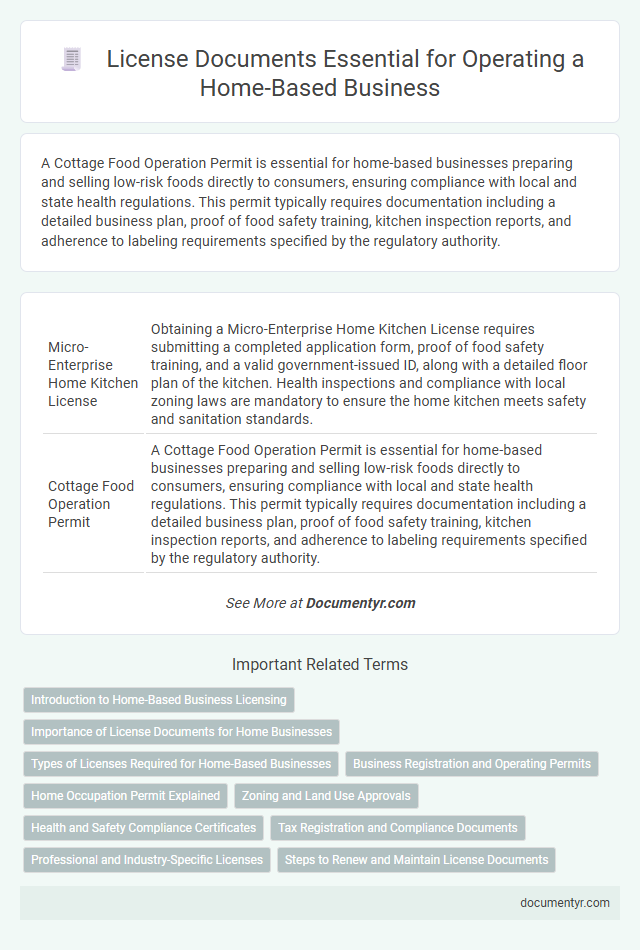

| Number | Name | Description |

|---|---|---|

| 1 | Micro-Enterprise Home Kitchen License | Obtaining a Micro-Enterprise Home Kitchen License requires submitting a completed application form, proof of food safety training, and a valid government-issued ID, along with a detailed floor plan of the kitchen. Health inspections and compliance with local zoning laws are mandatory to ensure the home kitchen meets safety and sanitation standards. |

| 2 | Cottage Food Operation Permit | A Cottage Food Operation Permit is essential for home-based businesses preparing and selling low-risk foods directly to consumers, ensuring compliance with local and state health regulations. This permit typically requires documentation including a detailed business plan, proof of food safety training, kitchen inspection reports, and adherence to labeling requirements specified by the regulatory authority. |

| 3 | Virtual Business Location License | A Virtual Business Location License is essential for home-based businesses operating without a physical storefront, ensuring legal compliance and legitimacy in jurisdictions that require proof of a business address. This license allows entrepreneurs to use a virtual office or co-working space address as the official business location, facilitating proper registration and receipt of business correspondence. |

| 4 | Home Occupation Permit | A Home Occupation Permit is essential for home-based businesses to legally operate within residential zones, ensuring compliance with local zoning laws and restrictions. This permit typically requires documentation such as proof of property ownership or lease agreement, a detailed business plan, and sometimes site inspections to verify that the business activities do not disrupt the neighborhood. |

| 5 | Remote Seller Sales Tax Permit | A Remote Seller Sales Tax Permit is essential for home-based businesses conducting sales across state lines, ensuring compliance with state tax regulations and collection requirements. This permit enables businesses to legally collect and remit sales tax, avoiding penalties and facilitating smooth interstate commerce. |

| 6 | Digital Product License | A digital product license for a home-based business typically requires documentation such as a software license agreement, terms of use, and proof of ownership or rights to distribute the digital content. These documents ensure legal protection for intellectual property and compliance with local business regulations, which vary by jurisdiction. |

| 7 | Green Home Certification | Obtaining a Green Home Certification requires submitting detailed documentation, including proof of energy-efficient installations, sustainable building materials, and compliance with local environmental regulations. These license documents validate a home-based business's commitment to eco-friendly practices and are essential for gaining certification approval. |

| 8 | Shared Economy Business Registration | Home-based businesses operating within the shared economy typically require a business license, zoning permits, and, depending on the service, specific regulatory compliance documents such as health or safety certifications. Registering with local government agencies and obtaining an Employer Identification Number (EIN) ensures legal operation and tax compliance in shared economy business models. |

| 9 | Zoning Variance for Home-Based Business | A zoning variance is required when local zoning laws restrict certain business activities in residential areas, allowing home-based businesses to legally operate despite these restrictions. Obtaining this document involves submitting an application to the local zoning board, demonstrating minimal impact on the neighborhood and compliance with safety and parking regulations. |

| 10 | E-Commerce Compliance Certificate | A Home-Based Business engaged in e-commerce must obtain an E-Commerce Compliance Certificate to meet regulatory standards and verify adherence to online transaction laws. This certificate ensures the business complies with consumer protection, data privacy, and digital payment security requirements mandated by local and federal authorities. |

Introduction to Home-Based Business Licensing

Starting a home-based business requires understanding the necessary license documents to operate legally. Licensing ensures compliance with local, state, and federal regulations, protecting both the business owner and customers. Identifying the correct permits and licenses is crucial for a smooth launch and ongoing operations of a home-based enterprise.

Importance of License Documents for Home Businesses

Operating a home-based business requires specific license documents to ensure legal compliance and avoid potential fines. These licenses validate that the business meets local, state, and federal regulations.

Proper license documentation protects the business owner from legal risks and enhances credibility with customers and suppliers. Obtaining the necessary permits demonstrates a commitment to professionalism and operational standards.

Types of Licenses Required for Home-Based Businesses

| Type of License | Description | Applicability |

|---|---|---|

| Business Operating License | Authorization issued by local government allowing you to legally conduct business within a specific jurisdiction. | Required for almost all home-based businesses to operate legally. |

| Home Occupation Permit | Permit ensuring the business activity complies with local zoning laws specifically for residential areas. | Necessary if your municipality requires confirmation that your home business won't disrupt the neighborhood. |

| Professional or Occupational License | Certification for specialized professions such as health care, legal services, or financial consulting. | Relevant when your business provides regulated professional services from home. |

| Sales Tax Permit | Allows collection and remittance of sales tax on goods and services sold. | Essential if your home-based business sells taxable products or services. |

| Health Department Permit | Certification ensuring compliance with health and safety regulations, often required for food-related businesses. | Required for businesses preparing or selling food items from home. |

| Sign Permit | Authorization to display advertising signs for your business on your property. | Needed if you plan to install visible business signage at your home location. |

Business Registration and Operating Permits

What license documents are necessary for a home-based business? Business registration is essential to legally establish your home-based business and ensure compliance with local laws. Operating permits may also be required to validate that your business activities meet zoning and safety regulations.

Home Occupation Permit Explained

Starting a home-based business requires obtaining specific license documents to ensure legal compliance. One critical document is the Home Occupation Permit, which allows entrepreneurs to operate their business within a residential area.

The Home Occupation Permit regulates the type and scale of business activities conducted at home to maintain neighborhood character and safety. It often involves restrictions on signage, customer visits, and noise levels. Securing this permit helps avoid fines and legal issues while fostering community acceptance of the home business.

Zoning and Land Use Approvals

Home-based businesses require specific license documents to comply with local zoning and land use regulations. These approvals ensure the business activity is permitted within a residential area.

Zoning permits verify that the property is designated for business operations and adhere to restrictions on signage, customer visits, and operational hours. Land use approvals may include obtaining a home occupation permit from the city or county planning department.

Health and Safety Compliance Certificates

Health and safety compliance certificates are essential license documents for home-based businesses to ensure they meet legal standards. These certificates verify that the business environment is safe for both employees and customers.

- Health Inspection Certificate - Confirms that the home business adheres to sanitation and hygiene regulations.

- Fire Safety Certificate - Validates that the property complies with fire safety codes to prevent hazards.

- Occupational Safety Certificate - Ensures that workspaces are designed to minimize risk and promote employee well-being.

Securing these documents helps home-based businesses operate within regulatory frameworks and maintain customer trust.

Tax Registration and Compliance Documents

Home-based businesses require specific license documents to operate legally and remain compliant with tax regulations. Proper tax registration and compliance documents ensure smooth financial operations and adherence to local, state, and federal tax laws.

- Tax Identification Number (TIN) - The TIN is essential for reporting taxes and opening business bank accounts related to your home-based business.

- Sales Tax Permit - This permit authorizes the collection of sales tax from customers, mandatory for businesses selling taxable goods or services.

- Employer Identification Number (EIN) - Required for tax reporting purposes if the business has employees or operates as a partnership or corporation.

Professional and Industry-Specific Licenses

Professional and industry-specific licenses are essential for home-based businesses to operate legally and maintain credibility. These licenses vary depending on the nature of the service or product offered, such as health permits for food-related businesses or contractor licenses for home renovation services. Obtaining the correct license ensures compliance with local regulations and industry standards, preventing fines and legal issues.

What License Documents Are Necessary for a Home-Based Business? Infographic