To obtain a business license for an LLC, you need several key documents including the Articles of Organization, which officially register your LLC with the state, and an Employer Identification Number (EIN) from the IRS for tax purposes. Proof of compliance with local zoning laws, such as a zoning permit or certificate of occupancy, is often required to operate legally in a specific location. Additional documentation may include a business name registration (DBA), operating agreement, and any industry-specific permits or certifications mandated by local or state authorities.

What Documents Are Needed to Obtain a Business License for an LLC?

| Number | Name | Description |

|---|---|---|

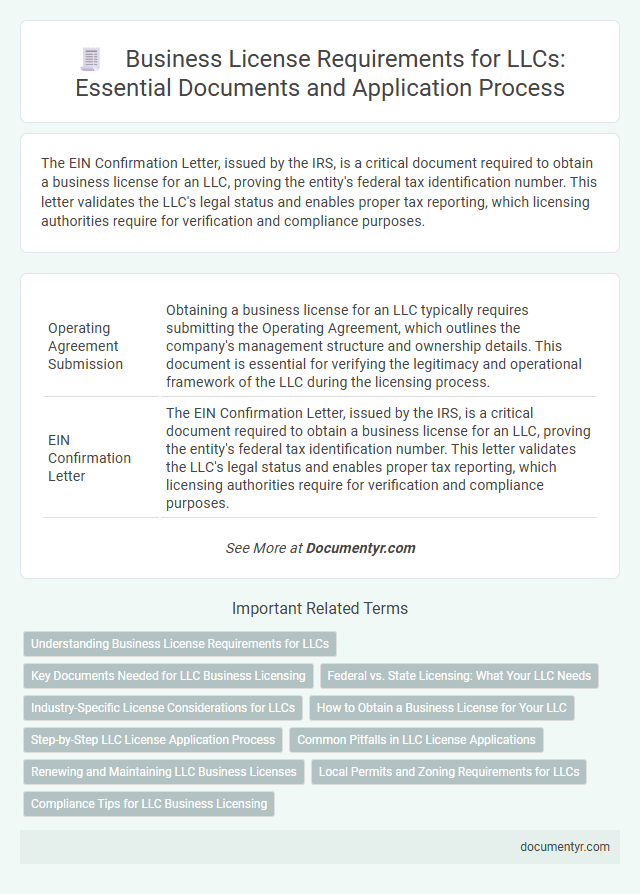

| 1 | Operating Agreement Submission | Obtaining a business license for an LLC typically requires submitting the Operating Agreement, which outlines the company's management structure and ownership details. This document is essential for verifying the legitimacy and operational framework of the LLC during the licensing process. |

| 2 | EIN Confirmation Letter | The EIN Confirmation Letter, issued by the IRS, is a critical document required to obtain a business license for an LLC, proving the entity's federal tax identification number. This letter validates the LLC's legal status and enables proper tax reporting, which licensing authorities require for verification and compliance purposes. |

| 3 | Registered Agent Consent Form | Obtaining a business license for an LLC requires submitting a Registered Agent Consent Form, which confirms the agent's agreement to accept legal documents on behalf of the LLC. This form is essential alongside the Articles of Organization and any state-specific identification documents to ensure compliance with local business regulations. |

| 4 | Formation Certificate (Articles of Organization) | To obtain a business license for an LLC, the Formation Certificate, also known as the Articles of Organization, is a crucial document that officially registers the LLC with the state. This document outlines key information such as the LLC's name, business purpose, registered agent, and management structure, serving as the primary proof of the LLC's legal formation required by licensing authorities. |

| 5 | Business Premises Zoning Approval | Business premises zoning approval requires submitting a detailed zoning application, property deed, and site plan to the local zoning authority to ensure the LLC's business location complies with municipal land-use regulations. Obtaining this approval is essential before acquiring a business license, as it verifies that the premises are zoned for the intended commercial activities. |

| 6 | Beneficial Ownership Information (BOI) Report | To obtain a business license for an LLC, submitting the Beneficial Ownership Information (BOI) Report is crucial as it identifies individuals owning or controlling 25% or more of the company. This document ensures compliance with regulatory requirements designed to enhance transparency and prevent illicit activities. |

| 7 | State Tax Registration Certificate | Obtaining a State Tax Registration Certificate is essential for an LLC to legally operate and fulfill tax obligations within the state. This document verifies the business's registration with the state tax authority, enabling tax reporting, collection, and compliance with state tax laws. |

| 8 | Local Municipality Compliance Affidavit | Obtaining a business license for an LLC requires submitting a Local Municipality Compliance Affidavit, which verifies adherence to zoning laws, fire codes, and health regulations specific to the area. This affidavit ensures the LLC meets all local legal requirements before official licensing approval. |

| 9 | Business Activity Description Statement | A comprehensive Business Activity Description Statement outlining the specific operations and services of the LLC is essential for obtaining a business license. This document helps licensing authorities assess compliance with local regulations and ensures the business aligns with permitted activities within the jurisdiction. |

| 10 | Trade Name (DBA) Registration Proof | Trade Name (DBA) Registration Proof is a critical document required to obtain a business license for an LLC, demonstrating legal authorization to operate under an assumed name. This proof typically includes a certificate or registration form issued by the state or local government confirming the official filing and acceptance of the DBA. |

Understanding Business License Requirements for LLCs

Obtaining a business license for an LLC requires submitting key documents such as the LLC formation certificate, employer identification number (EIN), and proof of address. Understanding business license requirements for LLCs involves verifying state-specific regulations and any industry-related permits. You must ensure all necessary documentation aligns with local jurisdiction standards to secure proper licensing.

Key Documents Needed for LLC Business Licensing

What documents are needed to obtain a business license for an LLC? Key documents include the Articles of Organization, which officially register your LLC with the state. You also need an Employer Identification Number (EIN) from the IRS for tax purposes.

Are operating agreements necessary when applying for an LLC business license? An operating agreement outlines the management structure and ownership of your LLC, often required by states or local jurisdictions. This document demonstrates how your LLC operates internally and resolves disputes.

Do you need proof of identification to get a business license for an LLC? Yes, valid identification such as a driver's license or passport is required to verify the identity of the LLC owners or members. This ensures accountability and compliance with licensing regulations.

Is proof of address required to obtain an LLC business license? A business address, often evidenced through a utility bill or lease agreement, is essential for your LLC license application. It shows the official location where your LLC will conduct business operations.

Are additional permits or certificates required alongside the basic LLC documents? Depending on your industry and location, you might need zoning permits, health permits, or sales tax certificates. Your local licensing authority will specify these based on your business activities.

Federal vs. State Licensing: What Your LLC Needs

Obtaining a business license for an LLC requires specific documents that vary depending on federal and state regulations. Federal licenses apply to industries regulated by federal agencies, while state licenses pertain to business operations within a specific state.

Federal licensing for an LLC may involve permits from agencies such as the FDA, EPA, or FCC, depending on the business activity. State licensing typically requires Articles of Organization, a Certificate of Formation, and proof of state tax registration to legally operate.

Industry-Specific License Considerations for LLCs

Obtaining a business license for an LLC requires specific documents that vary by industry, including a completed application form, proof of LLC registration, and identification documents. Industry-specific license considerations may include health permits for food businesses, professional licenses for services like accounting or real estate, and environmental permits for manufacturing. Understanding these requirements ensures your LLC complies with local regulations and operates legally within its market sector.

How to Obtain a Business License for Your LLC

Obtaining a business license for an LLC requires specific documents to complete the application process efficiently. Knowing the necessary paperwork helps streamline compliance with local and state regulations.

- Articles of Organization - This document officially registers your LLC with the state and verifies its legal existence.

- Federal Employer Identification Number (EIN) - The EIN is needed for tax purposes and to open business bank accounts.

- Operating Agreement - Although not always mandatory, this outlines the LLC's management structure and operating procedures.

Prepare these documents carefully to facilitate a smooth approval of your business license application.

Step-by-Step LLC License Application Process

| Step | Required Document | Description |

|---|---|---|

| 1 | Articles of Organization | Official document filed with the state to legally form the LLC, includes company name, address, and members' information. |

| 2 | Operating Agreement | Internal document outlining LLC management structure, member roles, and operating procedures, often required to support license application. |

| 3 | Employer Identification Number (EIN) | Issued by the IRS, the EIN is necessary for tax purposes and often required when applying for a business license. |

| 4 | Business License Application Form | Completed application provided by the local or state licensing authority specific to the business location and industry. |

| 5 | Proof of Address | Documents such as a lease agreement or utility bill confirming the physical location of the LLC. |

| 6 | Identification Documents | Valid government-issued IDs for LLC members or managers as required by the licensing authority. |

| 7 | Business Permits or Certifications | Special permits or certifications required depending on the LLC's industry, e.g., health permits, professional licenses. |

| 8 | Filing Fees | Payment receipts or proof of payment for the business license application fees as mandated by the jurisdiction. |

Common Pitfalls in LLC License Applications

Obtaining a business license for an LLC requires specific documents to ensure compliance with local regulations. Knowing the common pitfalls in LLC license applications can help you avoid delays and rejections.

- Incomplete Application Forms - Missing information or errors in the license application can result in automatic denial or processing delays.

- Failure to Submit Required Supporting Documents - Omitting essential documents like Articles of Organization or EIN verification often causes application rejections.

- Ignoring Local Zoning Requirements - Overlooking zoning permits or land use approvals may lead to non-compliance and license denial.

Renewing and Maintaining LLC Business Licenses

To renew and maintain an LLC business license, specific documents are required to ensure compliance with state regulations. These documents typically include the current business license, proof of payment of any fees or taxes, and updated registration forms.

Renewal usually involves submitting a renewal application form provided by the state or local licensing authority. Proof of ongoing business operations, such as updated tax filings or annual reports, may also be necessary. Keeping accurate and timely records helps avoid penalties and ensures the LLC remains in good standing.

Local Permits and Zoning Requirements for LLCs

Obtaining a business license for an LLC requires compliance with local permits and zoning regulations. These documents ensure that the business operates legally within the designated area.

- Local Business Permit - A permit issued by the city or county that authorizes the LLC to conduct business within the jurisdiction.

- Zoning Clearance - Verification that the LLC's business location complies with local zoning laws and land-use regulations.

- Special Use Permits - Required if the LLC's operations involve activities restricted by zoning codes, such as signage or environmental considerations.

What Documents Are Needed to Obtain a Business License for an LLC? Infographic