To obtain a business license in Illinois, essential documents include a completed application form, proof of identification, and proof of ownership or authorization to operate the business. Additional documents such as proof of business address, Federal Employer Identification Number (FEIN), and any industry-specific certifications may be required. Submitting all required paperwork accurately ensures compliance and smooth processing of the business license application.

What Documents Are Necessary for a Business License in Illinois?

| Number | Name | Description |

|---|---|---|

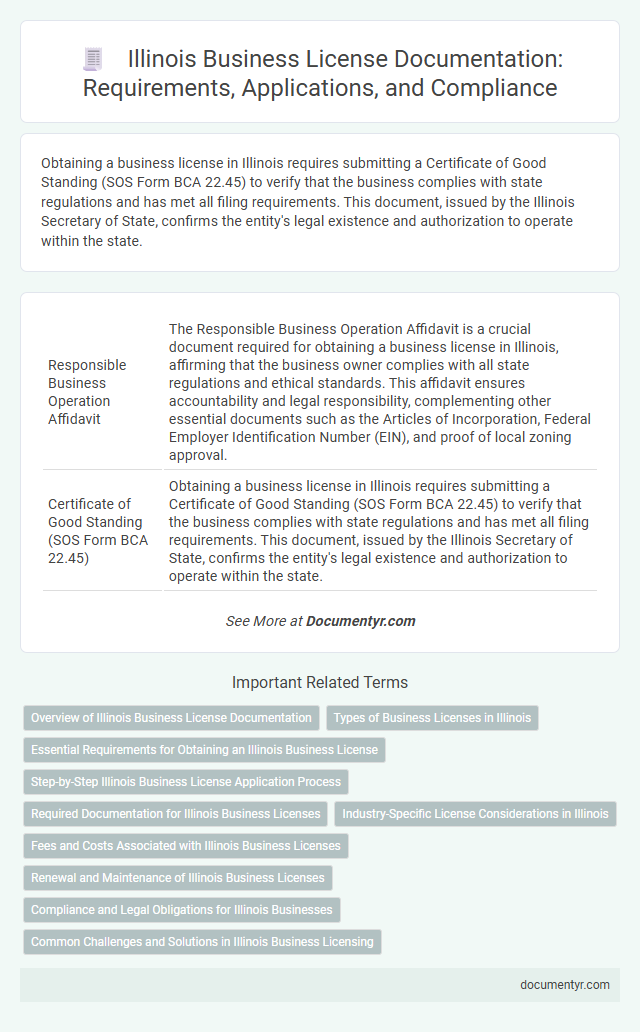

| 1 | Responsible Business Operation Affidavit | The Responsible Business Operation Affidavit is a crucial document required for obtaining a business license in Illinois, affirming that the business owner complies with all state regulations and ethical standards. This affidavit ensures accountability and legal responsibility, complementing other essential documents such as the Articles of Incorporation, Federal Employer Identification Number (EIN), and proof of local zoning approval. |

| 2 | Certificate of Good Standing (SOS Form BCA 22.45) | Obtaining a business license in Illinois requires submitting a Certificate of Good Standing (SOS Form BCA 22.45) to verify that the business complies with state regulations and has met all filing requirements. This document, issued by the Illinois Secretary of State, confirms the entity's legal existence and authorization to operate within the state. |

| 3 | Illinois Business Registration Application (Form REG-1) | The Illinois Business Registration Application (Form REG-1) is required to register a business for tax purposes and must be submitted to the Illinois Department of Revenue to obtain a business license. Essential documents accompanying Form REG-1 include proof of business address, federal Employer Identification Number (EIN), and identification details of owners or officers. |

| 4 | Zoning Compliance Certificate | A Zoning Compliance Certificate is essential for obtaining a business license in Illinois, verifying that the business location meets all local zoning requirements. This document must be obtained from the city or county zoning office to ensure the property is approved for the specific commercial activity planned. |

| 5 | State Sales Tax Permit (IBT Number) | Obtaining a Business License in Illinois requires a State Sales Tax Permit, known as the Illinois Business Tax (IBT) Number, which authorizes businesses to collect and remit sales tax. This permit is essential for retailers, service providers, and any business engaging in taxable sales within the state to ensure compliance with Illinois Department of Revenue regulations. |

| 6 | Proof of Chicago Labor Standards Compliance | To obtain a business license in Illinois, companies must provide proof of compliance with Chicago Labor Standards, including documentation verifying adherence to paid sick leave policies, minimum wage regulations, and fair workweek requirements. Submitting completed labor standards affidavits and current payroll records ensures fulfillment of the city's labor ordinances necessary for license approval. |

| 7 | Certified Environmental Impact Screening Form | The Certified Environmental Impact Screening Form is a crucial document required for obtaining a business license in Illinois, ensuring compliance with state environmental regulations. This form assesses potential environmental impacts of the proposed business activities, facilitating responsible development and adherence to legal standards. |

| 8 | Anti-Harassment Policy Attestation | Illinois business license applications require submission of an Anti-Harassment Policy Attestation to ensure compliance with state regulations promoting safe workplaces. This document must certify that the business has implemented a formal anti-harassment policy, which is essential for obtaining or renewing the license. |

| 9 | Digital Signature Verification Statement | Submitting a Digital Signature Verification Statement is essential for obtaining a business license in Illinois, as it authenticates electronic document submissions and ensures compliance with state regulations. This document must include the signer's identity verification and adhere to Illinois Digital Signature Act standards to validate the electronic approval process. |

| 10 | Social Equity Ownership Disclosure | A Social Equity Ownership Disclosure form is required as part of the application process for a business license in Illinois to verify compliance with state social equity programs aimed at supporting minority and disadvantaged entrepreneurs. Applicants must provide detailed ownership information, including the percentage of business ownership held by individuals qualifying under the social equity criteria, to ensure transparency and eligibility. |

Overview of Illinois Business License Documentation

Understanding the required documents is essential for obtaining a business license in Illinois. Proper documentation ensures a smooth application process with state and local authorities.

- Government-issued Identification - A valid ID, such as a driver's license or passport, verifies your identity during the application.

- Proof of Business Registration - Documents like Articles of Incorporation or a Certificate of Assumed Name confirm the business's legal formation.

- Tax Identification Numbers - Federal Employer Identification Number (EIN) or Social Security Number is necessary for tax and employment purposes.

Types of Business Licenses in Illinois

Obtaining a business license in Illinois requires submitting specific documents based on the type of business and licensing authority. Understanding the types of business licenses helps in preparing the necessary paperwork efficiently.

- General Business License - Required for most retail and service businesses, typically needing proof of identity, business registration, and fee payment.

- Professional Licenses - Mandatory for regulated professions like healthcare, legal services, and real estate, requiring certification, educational qualifications, and background checks.

- Specialty Licenses - Needed for industries such as liquor sales, food service, and construction, often involving health inspections, zoning approvals, and state permits.

Essential Requirements for Obtaining an Illinois Business License

Obtaining a business license in Illinois requires submitting specific documentation to ensure legal compliance. These documents verify business legitimacy and adherence to state regulations.

- Completed Application Form - Provides essential business information, including owner details and business activities.

- Proof of Identification - Valid government-issued ID to confirm the applicant's identity.

- Tax Registration Certificates - Documentation such as a Federal Employer Identification Number (EIN) and Illinois Department of Revenue tax registration.

Submitting all required documents accurately accelerates the processing of an Illinois business license.

Step-by-Step Illinois Business License Application Process

Obtaining a business license in Illinois requires specific documents to ensure a smooth application process. Key documents include a completed application form, proof of business address, and a valid government-issued ID.

The step-by-step Illinois business license application process begins with identifying the type of license needed based on your industry. Next, gather essential documents such as a federal Employer Identification Number (EIN), Articles of Incorporation or Organization, and zoning permits if applicable. Submit your application through the Illinois Department of Commerce and Economic Opportunity or the relevant local authority, and pay any required fees to complete the process.

Required Documentation for Illinois Business Licenses

To obtain a business license in Illinois, specific documents are required to ensure compliance with state regulations. These documents typically include a completed application form and proof of business registration with the Illinois Secretary of State.

Additional required documentation may include a federal Employer Identification Number (EIN) from the IRS and any applicable local permits or zoning clearances. Proof of Illinois tax registration and liability insurance can also be necessary depending on the business type and location.

Industry-Specific License Considerations in Illinois

Obtaining a business license in Illinois requires several essential documents, including a completed application form, proof of identification, and a valid Federal Employer Identification Number (FEIN). Industry-specific licenses demand additional documentation such as health permits for food-related businesses, professional certifications for healthcare services, and environmental compliance forms for manufacturing operations. Understanding these industry-specific requirements ensures businesses meet all regulatory standards to operate legally within Illinois.

Fees and Costs Associated with Illinois Business Licenses

```htmlWhat documents are necessary for obtaining a business license in Illinois? Applicants typically need to provide a completed application form, proof of identity, and business registration documents. Additional paperwork may include zoning permits and tax registration certificates.

What are the fees and costs associated with Illinois business licenses? License fees vary based on the type of business and location, ranging from $50 to several hundred dollars. Renewal fees and additional charges for special permits may also apply.

```Renewal and Maintenance of Illinois Business Licenses

Renewal and maintenance of Illinois business licenses require submitting updated documentation to remain compliant. Key documents include the renewal application form, proof of current business address, and payment of applicable fees. Businesses must also provide updated tax identification and any additional permits specific to their industry during the renewal process.

Compliance and Legal Obligations for Illinois Businesses

Obtaining a business license in Illinois requires specific documents to ensure compliance with state regulations. Essential paperwork includes a completed application form, proof of identification, and a certificate of occupancy if applicable.

Additional legal obligations may involve submitting tax registration certificates and verifying zoning approvals. Your business must also maintain up-to-date records to meet state and local compliance standards effectively.

What Documents Are Necessary for a Business License in Illinois? Infographic