To set up payroll for remote workers, essential documents include a completed W-4 form for tax withholding, state and local tax forms specific to the employee's location, and direct deposit authorization. Employers must also collect proof of identity and eligibility to work, such as a valid government-issued ID and an I-9 form. Accurate record-keeping of these documents ensures compliance with payroll and tax regulations across different jurisdictions.

What Documents are Necessary for Remote Worker Payroll Setup?

| Number | Name | Description |

|---|---|---|

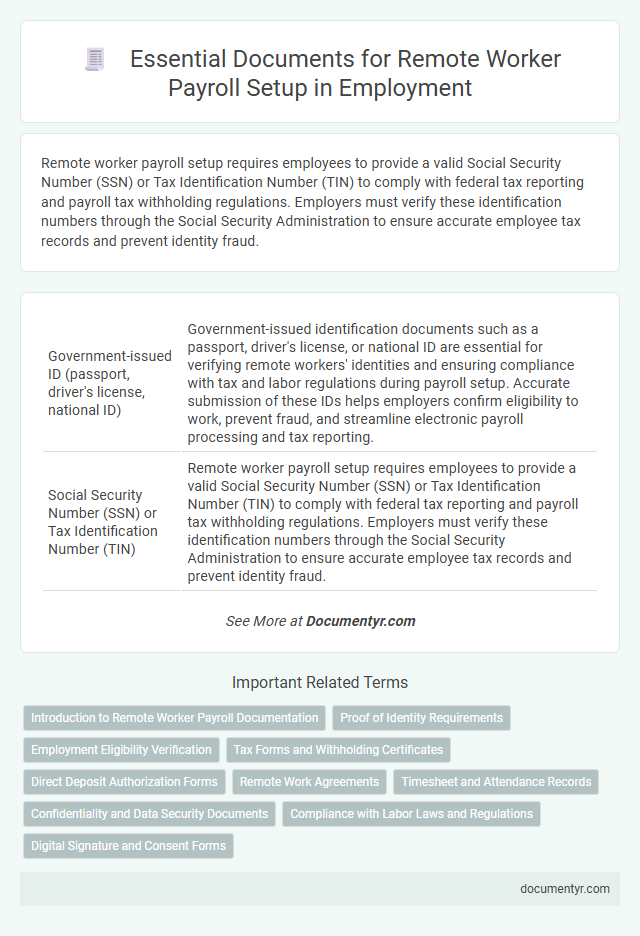

| 1 | Government-issued ID (passport, driver's license, national ID) | Government-issued identification documents such as a passport, driver's license, or national ID are essential for verifying remote workers' identities and ensuring compliance with tax and labor regulations during payroll setup. Accurate submission of these IDs helps employers confirm eligibility to work, prevent fraud, and streamline electronic payroll processing and tax reporting. |

| 2 | Social Security Number (SSN) or Tax Identification Number (TIN) | Remote worker payroll setup requires employees to provide a valid Social Security Number (SSN) or Tax Identification Number (TIN) to comply with federal tax reporting and payroll tax withholding regulations. Employers must verify these identification numbers through the Social Security Administration to ensure accurate employee tax records and prevent identity fraud. |

| 3 | Bank account details (voided check or direct deposit form) | To ensure accurate remote worker payroll setup, submitting bank account details such as a voided check or a direct deposit authorization form is essential for seamless salary transfers. These documents provide the necessary information for electronic payments, reducing processing errors and delays. |

| 4 | Completed W-4 form (US) / relevant tax withholding form | A completed W-4 form is essential for remote worker payroll setup in the US to accurately determine federal income tax withholding based on the employee's marital status and allowances. Employers must collect this form before processing payroll to ensure compliance with IRS regulations and precise tax deductions. |

| 5 | Employment contract or offer letter | An employment contract or offer letter outlining job role, salary, payment frequency, and tax withholding details is essential for remote worker payroll setup. These documents ensure legal compliance and accurate processing of wages and benefits across different jurisdictions. |

| 6 | Proof of address (utility bill, lease agreement) | Proof of address documents such as a recent utility bill or a lease agreement are essential for remote worker payroll setup to verify the employee's residential location. These documents ensure compliance with tax regulations and determine appropriate payroll tax rates based on the remote employee's state or country of residence. |

| 7 | Work eligibility authorization (work visa, permit if applicable) | Work eligibility authorization documents such as valid work visas or permits are essential for remote worker payroll setup to ensure legal compliance with employment laws. Employers must verify and securely store these authorizations to process payroll accurately and avoid legal penalties. |

| 8 | Emergency contact information | Emergency contact information is a crucial document for remote worker payroll setup, ensuring employers can quickly reach designated individuals in case of workplace emergencies or payroll issues. This information typically includes the contact's name, relationship to the employee, phone number, and email address, which helps maintain safety and communication compliance. |

| 9 | Non-disclosure agreement (NDA), if required | A Non-disclosure agreement (NDA) is essential for remote worker payroll setup to ensure confidentiality of sensitive payroll data and protect company financial information. Employers must secure a signed NDA from remote employees before processing payroll to comply with legal standards and maintain data security. |

| 10 | Remote work policy acknowledgment form | Employers must secure a signed remote work policy acknowledgment form to verify employee understanding of payroll procedures, tax implications, and compliance requirements specific to remote employment. This document is essential for aligning payroll setup with company policies and legal standards in diverse jurisdictions. |

| 11 | Payroll information form (company-specific) | A Payroll Information Form specific to the company is essential for remote worker payroll setup, as it collects critical data such as employee tax details, direct deposit information, and work authorization status. This document ensures accurate payroll processing, compliance with tax regulations, and timely compensation for remote employees. |

| 12 | State or local tax forms (if required) | Remote worker payroll setup requires state or local tax forms such as Form W-4 for state income tax withholding, state-specific withholding certificates, and any local tax registration documents mandated by the employee's work location. Employers must verify compliance with state and municipal tax regulations to ensure accurate tax deductions and reporting. |

| 13 | I-9 Employment Eligibility Verification (US, if applicable) | Remote worker payroll setup in the US requires the completion of the I-9 Employment Eligibility Verification form to confirm legal authorization to work, alongside valid identification documents such as a passport or driver's license and Social Security card. Employers must retain these documents for compliance with federal immigration and employment regulations during remote onboarding. |

| 14 | Personal information form (contact details, dependents, etc.) | A Personal Information Form is essential for remote worker payroll setup, capturing critical contact details, social security number, tax filing status, and dependent information to ensure accurate tax withholding and benefits administration. This form streamlines payroll processing by providing comprehensive data required for compliance with federal and state employment regulations. |

| 15 | Benefits enrollment forms (if applicable) | Benefits enrollment forms are essential for remote worker payroll setup to ensure accurate deduction of premiums and proper administration of health, retirement, and other employee benefits. Employers must collect completed forms to comply with benefit plan requirements and enable seamless integration with payroll systems. |

| 16 | Signed confidentiality or intellectual property agreement | A signed confidentiality or intellectual property agreement is essential for remote worker payroll setup to protect sensitive company information and ensure compliance with legal standards. This document safeguards proprietary data and clarifies intellectual property rights, minimizing risks related to data breaches or unauthorized use during payroll processing. |

Introduction to Remote Worker Payroll Documentation

Setting up payroll for remote workers requires specific documentation to ensure compliance with tax laws and accurate payment processing. Proper documentation helps streamline payroll management and reduce potential legal issues.

Essential documents include employment contracts, tax withholding forms, and proof of identity. These records enable employers to verify worker eligibility and accurately calculate withholdings and benefits.

Proof of Identity Requirements

Proof of identity is essential for remote worker payroll setup to verify eligibility and comply with legal regulations. Documents such as a valid passport, national ID card, or driver's license are commonly accepted. You must ensure these documents are current and accurately reflect your personal information for smooth payroll processing.

Employment Eligibility Verification

Employment Eligibility Verification is a crucial document for remote worker payroll setup. It confirms that the employee is legally authorized to work in the country.

Typically, Form I-9 must be completed and retained by the employer. You must collect acceptable identification documents as specified by the U.S. Citizenship and Immigration Services to verify identity and employment authorization.

Tax Forms and Withholding Certificates

Setting up payroll for remote workers requires specific tax forms and withholding certificates to ensure compliance with federal and state regulations. These documents confirm the employee's tax status and withholding preferences, essential for accurate tax reporting.

- Form W-4 - This federal tax form determines the correct amount of income tax to withhold from an employee's paycheck.

- State Withholding Certificate - Required if the remote worker resides in a state with income tax, it specifies state tax withholding details.

- Form I-9 - Used to verify the employee's identity and eligibility to work in the United States, critical for payroll legality.

Collecting and properly managing these documents streamlines payroll processing and ensures compliance for remote employees.

Direct Deposit Authorization Forms

Setting up payroll for a remote worker requires specific documentation to ensure accurate and timely payment. One crucial document is the Direct Deposit Authorization Form, which facilitates seamless salary transfers.

- Direct Deposit Authorization Form - This form authorizes the employer to deposit your salary directly into your bank account securely and efficiently.

- Bank Account Information - Providing accurate bank routing and account numbers on the form ensures payments are correctly processed without delays.

- Verification of Identity - Employers often require a government-issued ID to confirm the signer's identity on the authorization form, preventing fraud.

Remote Work Agreements

Setting up payroll for remote workers requires specific documentation to ensure compliance and accuracy. Remote work agreements are essential to outline the terms and conditions of employment.

Remote work agreements detail job responsibilities, work hours, and compensation structure, which are crucial for payroll processing. These agreements confirm the employee's remote status, helping to determine tax withholdings and benefits eligibility. You must have a signed agreement on file before initiating payroll setup for a remote worker.

Timesheet and Attendance Records

What documents are necessary for remote worker payroll setup? Timesheet and attendance records are essential components for accurate payroll processing. These documents verify hours worked and support compliance with labor regulations.

How do timesheet and attendance records impact remote payroll accuracy? Timesheets provide detailed tracking of hours, including overtime and breaks, ensuring correct wage calculations. Attendance records confirm presence and punctuality, helping to prevent payroll discrepancies.

Why must employers collect timesheet and attendance documents for remote workers? Collecting these documents ensures transparency and accountability in remote work arrangements. They facilitate audit trails and help resolve any payroll disputes efficiently.

Confidentiality and Data Security Documents

| Document | Description | Importance for Confidentiality and Data Security |

|---|---|---|

| Signed Confidentiality Agreement | Legal contract ensuring the remote worker agrees to protect sensitive company information. | Essential to prevent unauthorized access or sharing of payroll and personal data. |

| Data Protection Policy Acknowledgment | Document confirming remote workers understand and commit to the company's data security protocols. | Supports compliance with regulations like GDPR and enhances secure handling of payroll information. |

| Background Check Authorization | Permission form allowing the employer to verify the remote worker's criminal and employment history. | Helps maintain trustworthiness and integrity, reducing security risks in payroll processes. |

| Identity Verification Documents | Passports, driver's licenses, or government-issued IDs used to confirm worker identity. | Prevents identity fraud and ensures accurate payroll data management. |

| Secure Banking Information Form | Encrypted form for collecting direct deposit and banking details. | Protects financial data from breaches during payroll transactions. |

| Non-Disclosure Agreement (NDA) | Contract specifying confidentiality obligations related to company information accessed by the remote worker. | Minimizes risk of sensitive payroll information being leaked or misused. |

Compliance with Labor Laws and Regulations

Setting up payroll for remote workers requires specific documentation to ensure compliance with labor laws and regulations. Accurate records protect both the employer and employee by adhering to legal standards across jurisdictions.

- Valid Work Authorization - Proof of the remote worker's legal ability to work in their location is essential for lawful employment.

- Completed Tax Forms - Submission of appropriate tax forms such as W-4 or equivalent ensures proper withholding and reporting for payroll taxes.

- Employment Agreement - A signed contract outlining work terms aligns with labor regulations and clarifies payroll responsibilities.

What Documents are Necessary for Remote Worker Payroll Setup? Infographic