Students applying for FAFSA need their Social Security number, driver's license (if applicable), and federal income tax returns from the previous year. They must also provide information about their parents' financial status if they are dependent students. Accurate documentation ensures timely processing and eligibility for federal student aid.

What Documents Does a Student Need for FAFSA Application?

| Number | Name | Description |

|---|---|---|

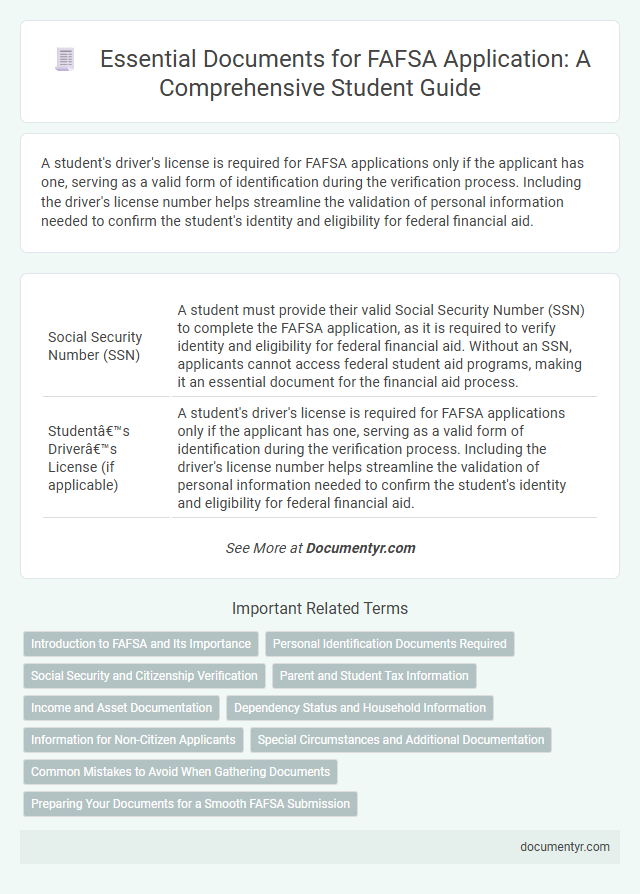

| 1 | Social Security Number (SSN) | A student must provide their valid Social Security Number (SSN) to complete the FAFSA application, as it is required to verify identity and eligibility for federal financial aid. Without an SSN, applicants cannot access federal student aid programs, making it an essential document for the financial aid process. |

| 2 | Student’s Driver’s License (if applicable) | A student's driver's license is required for FAFSA applications only if the applicant has one, serving as a valid form of identification during the verification process. Including the driver's license number helps streamline the validation of personal information needed to confirm the student's identity and eligibility for federal financial aid. |

| 3 | Alien Registration Number (if not a U.S. citizen) | Students who are not U.S. citizens must provide their Alien Registration Number (A-Number) on the FAFSA application to verify their eligibility for federal student aid. This unique identifier, found on permanent resident cards or other immigration documents, is essential for processing financial aid for eligible non-citizen applicants. |

| 4 | Federal Income Tax Returns (1040 form) | Students must submit their Federal Income Tax Returns, specifically the IRS Form 1040, when applying for FAFSA to verify their financial information accurately. This document provides essential income details used to calculate the Expected Family Contribution (EFC), which determines eligibility for federal student aid. |

| 5 | W-2 Forms and Records of Income Earned | Students applying for FAFSA must provide W-2 forms to verify earned income, as these documents report wages and taxes withheld from the previous year. Accurate records of income earned, including pay stubs or other proof of earnings, are essential to ensure the FAFSA application reflects the student's financial situation correctly. |

| 6 | Records of Untaxed Income | Students must submit detailed records of untaxed income for the FAFSA application, including child support received, veterans' noneducation benefits, and untaxed portions of pensions. Accurate documentation of such income sources ensures precise calculation of the Expected Family Contribution (EFC) for federal financial aid eligibility. |

| 7 | Bank Statements | Students applying for FAFSA need recent bank statements to verify available financial resources, ensuring accurate reporting of cash, savings, and checking account balances. These statements support the assessment of a family's financial situation, which directly impacts eligibility for federal student aid programs. |

| 8 | Investment Records (stocks, bonds, real estate) | Students applying for FAFSA must provide accurate investment records, including details of stocks, bonds, and real estate holdings, as these assets directly impact the Expected Family Contribution calculation. Gathering recent statements or official documents verifying the current value of these investments ensures precise financial reporting and eligibility assessment. |

| 9 | Parent’s Federal Income Tax Returns (if dependent) | For FAFSA application, dependent students must submit their parent's federal income tax returns, including IRS Form 1040, to verify household income and tax information accurately. These documents are essential for determining eligibility for federal financial aid, grants, and student loans based on the family's financial situation. |

| 10 | Parent’s W-2 Forms and Income Records | Students applying for FAFSA must provide their parent's W-2 forms and income records to verify household income accurately, which directly impacts financial aid eligibility. These documents include recent W-2 wage statements and records of any additional income sources such as untaxed income or benefits, ensuring the FAFSA application reflects the family's true financial situation. |

| 11 | Parent’s Records of Untaxed Income | Parents must provide records of untaxed income such as child support received, tax-exempt interest, and workers' compensation benefits when completing the FAFSA application. These documents are essential for accurately calculating the Expected Family Contribution (EFC) and determining federal student aid eligibility. |

| 12 | Parent’s Bank Statements | Parents must provide recent bank statements detailing checking, savings, and investment account balances to verify financial information for the FAFSA application. These documents help accurately assess the Expected Family Contribution and determine eligibility for federal student aid. |

| 13 | Parent’s Investment Records | For the FAFSA application, students need to provide detailed information about their parent's investment records, including current balances of savings accounts, stocks, bonds, mutual funds, and other investment assets reported on tax returns or financial statements. Accurate disclosure of these investment records is crucial for determining the Expected Family Contribution (EFC) and eligibility for federal student aid. |

| 14 | FAFSA Account Username and Password (FSA ID) | Students need to create a Federal Student Aid (FSA) ID, comprising a unique username and password, to access and sign the FAFSA application electronically. This FSA ID serves as the official login credential required for submitting the FAFSA and managing federal student aid information securely. |

| 15 | List of Schools to Receive FAFSA Information | Students must provide a Federal School Code for each institution on their FAFSA form to ensure their financial information is sent to the correct colleges. It is important to list all potential schools, including the primary choice and backup options, as this determines where the Student Aid Report (SAR) and other financial data will be distributed. |

Introduction to FAFSA and Its Importance

The Free Application for Federal Student Aid (FAFSA) is a crucial step for students seeking financial assistance for college. It determines eligibility for federal grants, loans, and work-study programs.

Submitting a complete FAFSA application requires specific documents to verify financial and personal information. Key documents include the student's Social Security number, federal income tax returns, and records of untaxed income. Having these documents ready ensures a smooth and accurate application process, increasing the chances of receiving aid.

Personal Identification Documents Required

The Free Application for Federal Student Aid (FAFSA) requires specific personal identification documents to verify your identity and eligibility. Essential documents include a valid Social Security card, a driver's license or state ID, and your Alien Registration Number if you are not a U.S. citizen. Ensure all information matches exactly to avoid processing delays in your FAFSA application.

Social Security and Citizenship Verification

Students applying for FAFSA must provide a valid Social Security Number (SSN) to verify their identity and eligibility. Proof of U.S. citizenship or eligible noncitizen status is required, such as a U.S. birth certificate, passport, or permanent resident card. These documents ensure accurate processing of the FAFSA application and determine access to federal student aid.

Parent and Student Tax Information

Students applying for FAFSA must provide accurate tax information, including federal tax returns submitted by both the student and their parents. These documents help determine the Expected Family Contribution (EFC), which influences financial aid eligibility.

Parents need to submit their IRS tax return transcripts or signed copies of their 1040 forms to verify income. Students should also include their own tax returns if they earned income during the tax year relevant to the application.

Income and Asset Documentation

| Document Type | Description |

|---|---|

| Income Tax Returns | Federal income tax returns (Form 1040, 1040A, or 1040EZ) from the most recent tax year to verify earned income. |

| W-2 Forms | W-2 forms from all employers to confirm wages earned during the tax year. |

| Records of Untaxed Income | Documentation for untaxed income such as child support received, interest income, and veterans' benefits. |

| Bank Statements | Recent bank statements detailing current balances for checking and savings accounts. |

| Investment Records | Statements of investments, including stocks, bonds, mutual funds, and real estate investments excluding the home you live in. |

| Business and Farm Records | Documentation of net worth and value of business or farm assets if applicable. |

Dependency Status and Household Information

Understanding your dependency status is essential for completing the FAFSA application accurately. Household information directly affects the financial aid amount you may qualify for.

- Proof of Dependency Status - Documentation such as birth certificates, marriage licenses, or legal guardianship papers is needed to verify if a student is dependent or independent.

- Household Size Verification - Records like tax returns or a signed statement confirm the number of people living in your household, which impacts aid eligibility.

- Parental Financial Information - Dependent students must submit parents' tax returns and income statements to provide a full picture of household finances.

Information for Non-Citizen Applicants

Non-citizen applicants must provide specific documentation when applying for FAFSA to verify their eligibility for federal student aid. Understanding the required documents ensures a smoother application process and helps avoid delays.

- Alien Registration Number (A-Number) - This number is required for permanent residents and certain eligible non-citizens to prove legal immigration status.

- Visa or Residency Documentation - Non-citizen applicants need to submit valid visa types such as F-1, J-1, or other qualifying statuses as evidence of lawful presence.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - An SSN is preferred, but an ITIN may be accepted depending on individual circumstances and aid eligibility.

Providing accurate and complete documentation helps non-citizen students qualify for available federal and state financial aid programs.

Special Circumstances and Additional Documentation

Applying for FAFSA requires specific documents, especially when dealing with special circumstances. Having the right additional documentation ensures accurate financial aid processing.

- Proof of Special Circumstances - Documentation such as a letter from a social worker or a court order verifies situations like foster care or guardianship.

- Income Documentation - Tax returns, W-2 forms, or proof of income help clarify financial status when standard forms do not apply.

- Verification Worksheets - FAFSA may require signed verification worksheets to confirm the accuracy of the submitted information.

Common Mistakes to Avoid When Gathering Documents

Gathering the correct documents for a FAFSA application is crucial to avoid delays and errors. Common required documents include your Social Security number, federal income tax returns, and records of untaxed income.

One frequent mistake is submitting outdated or incorrect tax information, which can lead to FAFSA rejection. Another error is forgetting to include documentation for parents' financial details if you are a dependent student.

What Documents Does a Student Need for FAFSA Application? Infographic