Homebuyers need several key documents for real estate closing, including the purchase agreement, proof of homeowner's insurance, and a government-issued ID. Lenders typically require a mortgage commitment letter, pay stubs, and bank statements to verify financial stability. The closing disclosure, title insurance policy, and any property inspection reports are also essential for a smooth transaction.

What Documents Does a Homebuyer Need for Real Estate Closing?

| Number | Name | Description |

|---|---|---|

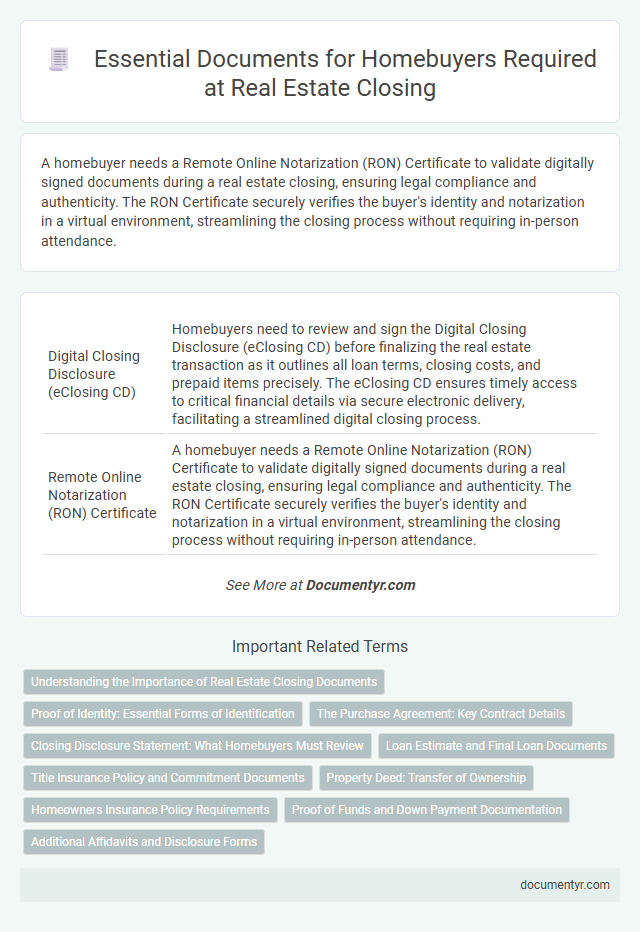

| 1 | Digital Closing Disclosure (eClosing CD) | Homebuyers need to review and sign the Digital Closing Disclosure (eClosing CD) before finalizing the real estate transaction as it outlines all loan terms, closing costs, and prepaid items precisely. The eClosing CD ensures timely access to critical financial details via secure electronic delivery, facilitating a streamlined digital closing process. |

| 2 | Remote Online Notarization (RON) Certificate | A homebuyer needs a Remote Online Notarization (RON) Certificate to validate digitally signed documents during a real estate closing, ensuring legal compliance and authenticity. The RON Certificate securely verifies the buyer's identity and notarization in a virtual environment, streamlining the closing process without requiring in-person attendance. |

| 3 | E-Note with Tamper-Seal | Homebuyers need the E-Note with Tamper-Seal as a crucial document for real estate closing, ensuring the electronic promissory note is secure and unaltered. This digital proof of loan terms maintains authenticity and compliance, streamlining the closing process and protecting all parties involved. |

| 4 | Blockchain Title Verification | Homebuyers need documents such as the sales contract, mortgage agreement, property deed, and government-issued ID for real estate closing, while Blockchain Title Verification enhances the process by providing a secure, immutable digital record of property ownership and transaction history. This technology reduces fraud risk and accelerates title transfer, making the closing more efficient and transparent. |

| 5 | Hybrid E-closing Consent Form | The Hybrid E-closing Consent Form authorizes the use of electronic documents and signatures during the real estate closing process, streamlining the transaction and reducing paper usage. Homebuyers must review and sign this form to ensure compliance with legal requirements and facilitate a smooth hybrid closing experience. |

| 6 | Two-Factor Authentication Acknowledgment | Homebuyers must submit a Two-Factor Authentication Acknowledgment during real estate closing to verify their identity and enhance transaction security. This document ensures secure access to online escrow accounts and protects sensitive information throughout the contract finalization process. |

| 7 | Cybersecurity Attestation for Wire Transfers | Homebuyers must present a cybersecurity attestation for wire transfers during real estate closing to confirm the authenticity and security of electronic payments, reducing the risk of fraud in the transaction. This document typically includes a signed certification from both parties verifying secure communication protocols and encrypted transfer methods. |

| 8 | TRID Compliance Confirmation | Homebuyers must provide a TRID Compliance Confirmation document verifying receipt of the Loan Estimate and Closing Disclosure within the required timeframes to ensure adherence to federal regulations. This confirmation safeguards transparent communication and disclosure of loan terms crucial for a smooth real estate closing process. |

| 9 | Grantor’s Digital Statutory Affidavit | The Grantor's Digital Statutory Affidavit is essential for real estate closing as it legally verifies the seller's identity, property ownership, and compliance with state laws through a digitally signed declaration. This digital affidavit streamlines the closing process by providing a secure, legally binding document that replaces traditional paper affidavits, ensuring authenticity and reducing delays. |

| 10 | Electronic Recording Receipt (e-Record) | The Electronic Recording Receipt (e-Record) is a crucial document for homebuyers during real estate closing, serving as proof that the deed and mortgage documents have been officially recorded with the county. This digital confirmation ensures legal transfer of property ownership and protects the buyer's rights by maintaining an accurate, tamper-proof public record. |

Understanding the Importance of Real Estate Closing Documents

Real estate closing documents are essential to finalize the purchase of your new home, ensuring all legal and financial obligations are met. Key documents include the deed, closing disclosure, and loan agreement, each verifying ownership transfer, costs, and loan terms. Understanding the importance of these papers helps protect your investment and guarantees a smooth closing process.

Proof of Identity: Essential Forms of Identification

Proof of identity is a crucial requirement for homebuyers during real estate closing to verify their legal status and prevent fraud. Specific forms of identification must be presented to complete this process smoothly.

- Government-issued photo ID - Typically includes a valid driver's license or passport to confirm the buyer's identity.

- Social Security number documentation - Used for credit checks and tax reporting purposes during the transaction.

- Secondary ID - May include a utility bill or bank statement to verify the buyer's current address.

Presenting these essential identification documents ensures a secure and efficient real estate closing for all parties involved.

The Purchase Agreement: Key Contract Details

The Purchase Agreement is the central contract in a real estate closing, outlining the terms and conditions agreed upon by the buyer and seller. This document includes essential details such as the purchase price, property description, and deadlines for inspections and financing.

You should review the Purchase Agreement carefully to ensure all key contract details align with your understanding. This document also specifies contingencies that must be met before closing, protecting your interests throughout the transaction.

Closing Disclosure Statement: What Homebuyers Must Review

The Closing Disclosure Statement is a critical document that homebuyers must carefully review before finalizing a real estate transaction. It outlines the loan terms, projected monthly payments, and detailed closing costs, enabling buyers to understand the financial commitments involved. Homebuyers should verify all information for accuracy and address any discrepancies with their lender prior to closing.

Loan Estimate and Final Loan Documents

What documents are essential for a homebuyer to bring to a real estate closing? A Loan Estimate provides an overview of your mortgage terms and expected costs early in the process. Final Loan Documents finalize your mortgage details, confirming your agreement and financial commitments for the property purchase.

Title Insurance Policy and Commitment Documents

Title insurance policy and commitment documents are essential for a smooth real estate closing. These documents protect your ownership rights and ensure there are no undisclosed liens or claims on the property.

The title insurance policy provides financial protection against title defects, while the commitment document outlines the conditions that must be met before issuance. Having these documents ready helps prevent legal disputes after the closing process.

Property Deed: Transfer of Ownership

The property deed is a critical document in the real estate closing process as it legally transfers ownership from the seller to the buyer. This document must be carefully reviewed and signed to ensure a valid and enforceable property transfer.

- Legal proof of ownership - The property deed serves as official evidence that the buyer has obtained title to the property.

- Includes a detailed property description - The deed outlines the legal boundaries and specifics of the real estate parcel being transferred.

- Requires notarization and recording - The deed must be notarized and recorded with the local government to be legally binding and public.

Homeowners Insurance Policy Requirements

Understanding the homeowners insurance policy requirements is essential for a smooth real estate closing. Lenders require proof of adequate insurance coverage to protect the property investment.

- Proof of Homeowners Insurance Policy - You must provide an official insurance binder or policy declaration page showing active coverage on the property.

- Coverage Amount Verification - The policy must meet or exceed the lender's minimum coverage requirements, typically covering the home's replacement cost.

- Named Insured and Mortgagee - The homeowners insurance policy must list you as the insured and the lender or mortgage company as the mortgagee to safeguard all parties involved.

Proof of Funds and Down Payment Documentation

| Document | Description | Purpose |

|---|---|---|

| Proof of Funds | Official bank statements, investment account statements, or certified letters from financial institutions verifying available funds. | Confirms the homebuyer has sufficient liquid assets to cover the purchase price or closing costs, ensuring financial readiness for the transaction. |

| Down Payment Documentation | Bank statements, gift letters, or withdrawal slips showing the source and availability of funds allocated for the down payment. | Demonstrates the source and availability of funds designated for the down payment, which lenders and sellers require to confirm commitment and compliance with loan terms. |

What Documents Does a Homebuyer Need for Real Estate Closing? Infographic