Contractors need to provide a detailed contract agreement, proof of work completion such as invoices or progress reports, and photographic evidence of damages or repairs when submitting an insurance claim. They must also include any correspondence with the insurance company and a completed claim form to ensure the process moves smoothly. Accurate documentation helps validate the claim and expedites reimbursement.

What Documents Does a Contractor Need for Insurance Claim Submission?

| Number | Name | Description |

|---|---|---|

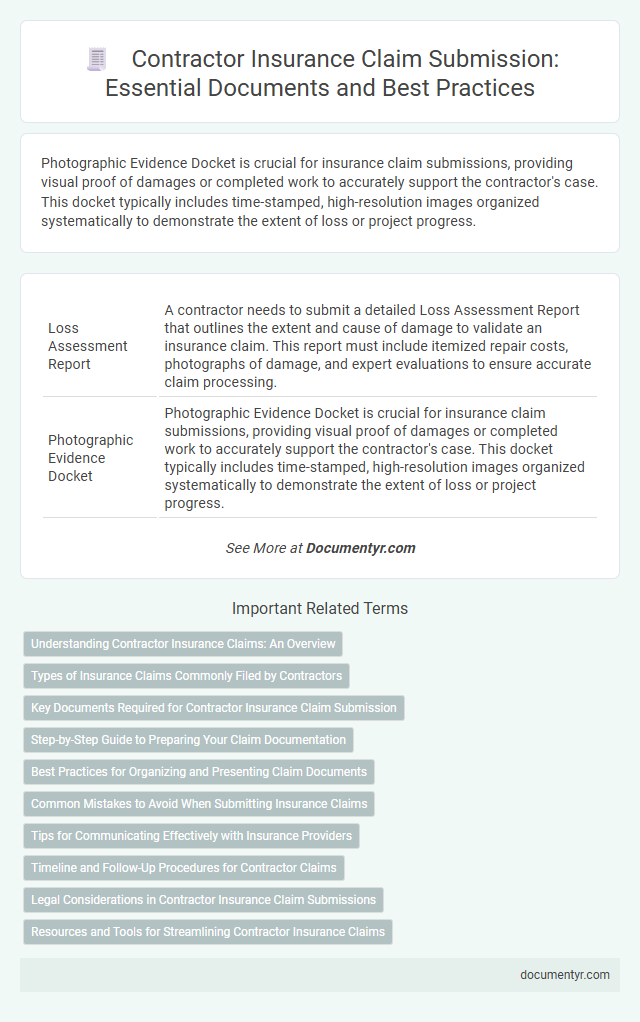

| 1 | Loss Assessment Report | A contractor needs to submit a detailed Loss Assessment Report that outlines the extent and cause of damage to validate an insurance claim. This report must include itemized repair costs, photographs of damage, and expert evaluations to ensure accurate claim processing. |

| 2 | Photographic Evidence Docket | Photographic Evidence Docket is crucial for insurance claim submissions, providing visual proof of damages or completed work to accurately support the contractor's case. This docket typically includes time-stamped, high-resolution images organized systematically to demonstrate the extent of loss or project progress. |

| 3 | Electronic Time-Stamped Work Log | A contractor must submit an electronic time-stamped work log as critical evidence in insurance claims to verify the exact dates and hours worked on the project, ensuring accurate validation of labor activities. This log, combined with invoices and project schedules, substantiates the claim by providing a reliable, tamper-proof record essential for insurance assessments. |

| 4 | Digital Repair Invoice Packet | A contractor must provide a comprehensive Digital Repair Invoice Packet, including itemized repair costs, labor details, material receipts, and photographic evidence of damages and repairs to ensure accurate insurance claim submission. This packet serves as critical documentation for validating repair work and supporting the claim's approval process. |

| 5 | Insurance Policy Endorsement Sheet | The Insurance Policy Endorsement Sheet is crucial for a contractor's insurance claim submission as it details the specific coverage modifications and endorsements that apply to the standard policy. This document verifies the extent of coverage, including any additional insured parties or altered terms, ensuring accurate claim processing and compliance with contractual requirements. |

| 6 | Subcontractor Compliance Affidavit | The subcontractor compliance affidavit is a critical document verifying that all subcontractors have met contractual obligations and regulatory requirements for insurance claim submission. This affidavit ensures accountability and supports the contractor's claim by confirming that subcontractors have adhered to safety standards, licensing, and insurance mandates. |

| 7 | Remote Inspection Certification | A contractor must include a Remote Inspection Certification alongside the project contract, detailed work scope, and proof of compliance with safety standards when submitting an insurance claim. This certification verifies that the inspection was conducted remotely using approved technology, ensuring accurate damage assessment without on-site presence. |

| 8 | Material Traceability Ledger | A Material Traceability Ledger is essential for insurance claim submission as it provides detailed documentation of all materials used, including their origin, batch numbers, and quality certifications. This ledger ensures the authenticity and compliance of materials, facilitating accurate validation and processing of the contractor's insurance claims. |

| 9 | Drone Footage Validation File | Contractors must provide a Drone Footage Validation File that includes geo-tagged video recordings and timestamped images to accurately support damage assessments during insurance claim submissions. This file enhances claim verification by offering precise visual evidence captured from aerial perspectives, ensuring comprehensive documentation of the affected property. |

| 10 | AI-Generated Damage Analytics | For insurance claim submission, a contractor needs AI-generated damage analytics reports that provide precise, data-driven assessments of structural impairments, alongside standard documents such as the insurance policy, detailed repair estimates, and photographic evidence. These AI-enhanced analytics improve claim accuracy by identifying damage extent and cost implications through machine learning algorithms, expediting approval processes. |

Understanding Contractor Insurance Claims: An Overview

Understanding contractor insurance claims is crucial for efficient claim submission. Proper documentation ensures a smoother process and faster resolution.

Contractors need to gather essential documents such as the original contract, proof of work completed, and detailed invoices. Insurance claim forms provided by the insurer must be accurately filled out. Including photos of the damage or incident can support your claim effectively.

Types of Insurance Claims Commonly Filed by Contractors

Contractors commonly file insurance claims related to property damage, liability, and worker injuries. Accurate documentation is essential to support these claims and ensure timely processing.

Key documents include the original contract, proof of damage or loss, detailed repair estimates, and incident reports. These materials provide clear evidence to substantiate the claim and facilitate communication with the insurance provider.

Key Documents Required for Contractor Insurance Claim Submission

Key documents required for contractor insurance claim submission include the original contract agreement, detailed project invoices, and proof of loss or damage. You must also provide photographs or videos of the damaged work, inspection reports, and any correspondence related to the claim. These documents help verify the claim's legitimacy and expedite the approval process.

Step-by-Step Guide to Preparing Your Claim Documentation

| Step | Required Document | Description |

|---|---|---|

| 1 | Insurance Policy Copy | Attach a complete copy of the contractor's insurance policy to verify coverage details and claim eligibility. |

| 2 | Incident Report | Provide a detailed report describing the incident that caused the claim, including date, time, location, and circumstances. |

| 3 | Damage Assessment | Include a professional evaluation or estimate of damages sustained, outlining repair or replacement costs. |

| 4 | Photographic Evidence | Submit clear photos of the damaged property and any relevant surrounding conditions to support the claim. |

| 5 | Contractor License and Credentials | Provide valid license documentation and credentials to prove professional licensing and qualifications. |

| 6 | Invoices and Receipts | Attach all relevant invoices, receipts, and payment proof related to materials and labor for the project. |

| 7 | Communication Records | Provide copies of any email, letters, or communication with the insurance company and clients pertaining to the claim. |

| 8 | Completion Certificates | Include certificates or official documentation proving the completion of phases of work prior to the incident if applicable. |

| 9 | Proof of Loss Form | Complete and submit the insurance company's Proof of Loss form detailing the financial impact of the incident. |

| 10 | Witness Statements | Gather written statements from witnesses who can corroborate the events leading to the claim. |

Best Practices for Organizing and Presenting Claim Documents

Submitting an insurance claim as a contractor requires a thorough collection of specific documents to ensure smooth processing. Organizing and presenting these documents clearly helps avoid delays and strengthens your claim.

- Gather Detailed Contract Agreements - Include scope of work, timelines, and payment terms to validate the claim's context.

- Compile Damage or Incident Reports - Provide accurate descriptions and photographic evidence to support the insurance loss cause.

- Submit Proof of Payments and Receipts - Detail all project-related expenses and costs to substantiate claim amounts.

Common Mistakes to Avoid When Submitting Insurance Claims

What documents does a contractor need for insurance claim submission? Proper paperwork includes the original contract, detailed invoices, photographs of damages, and repair estimates. Missing or incomplete documents often cause claim delays or denials.

What are common mistakes to avoid when submitting insurance claims? Failing to provide clear evidence of damages and inaccurate information on claim forms frequently result in rejected claims. Ensuring all documents are accurate and comprehensive can protect your rights and speed up the process.

Tips for Communicating Effectively with Insurance Providers

Effective communication with insurance providers is essential for a smooth claims process. Understanding the required documents and maintaining clear dialogue prevents delays and misunderstandings.

- Gather Complete Documentation - Ensure to collect all relevant contracts, work orders, and proof of expenses before contacting the insurer.

- Be Clear and Concise - Provide precise details about the claim, avoiding ambiguity to facilitate quicker decision-making.

- Keep Records of Correspondence - Document all communications with the insurance company for future reference and evidence of timely reporting.

Timeline and Follow-Up Procedures for Contractor Claims

Contractors must submit essential documents such as the signed contract, detailed scope of work, and proof of incurred expenses promptly to initiate insurance claim processing. Adhering to specific timelines outlined in the insurance policy, typically within 30 to 60 days of the incident, ensures timely claim acceptance and avoids rejection. Regular follow-up procedures include maintaining communication with the insurance adjuster, providing requested additional documentation, and tracking claim status until resolution.

Legal Considerations in Contractor Insurance Claim Submissions

Contractors must gather specific legal documents to ensure a smooth insurance claim submission process. These documents typically include the original contract, proof of project scope, and detailed work records.

Legal considerations require contractors to also provide evidence of compliance with local regulations and licensing certifications. Failure to submit these essential documents can result in claim denials or legal disputes.

What Documents Does a Contractor Need for Insurance Claim Submission? Infographic