To obtain a nonprofit incorporation certificate, you typically need the Articles of Incorporation, which outline the nonprofit's purpose and structure. You must also provide a completed application form, proof of the registered agent's consent, and any required filing fees. Including your nonprofit's bylaws and an EIN (Employer Identification Number) may be necessary depending on the jurisdiction.

What Documents Do You Need for a Nonprofit Incorporation Certificate?

| Number | Name | Description |

|---|---|---|

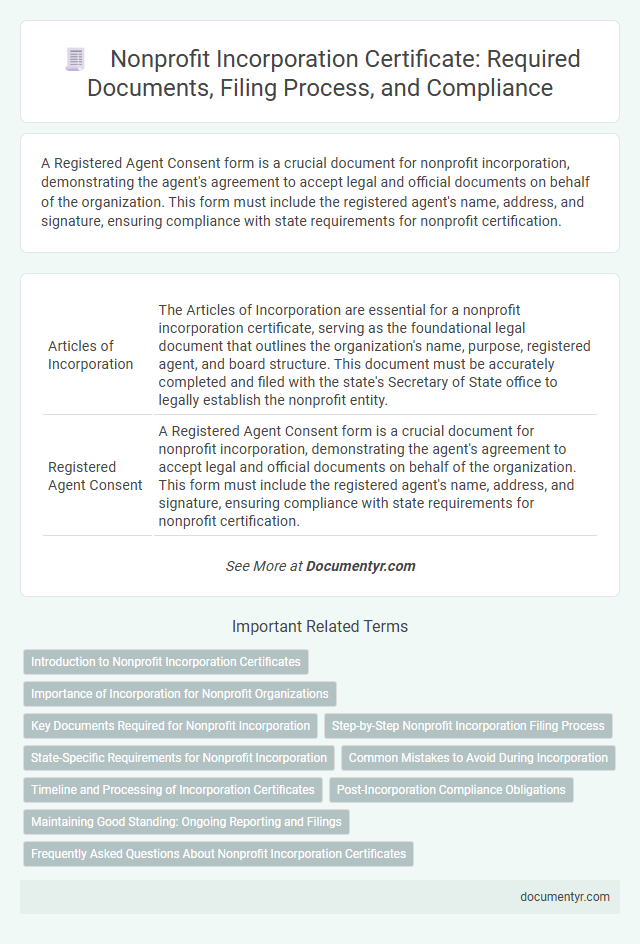

| 1 | Articles of Incorporation | The Articles of Incorporation are essential for a nonprofit incorporation certificate, serving as the foundational legal document that outlines the organization's name, purpose, registered agent, and board structure. This document must be accurately completed and filed with the state's Secretary of State office to legally establish the nonprofit entity. |

| 2 | Registered Agent Consent | A Registered Agent Consent form is a crucial document for nonprofit incorporation, demonstrating the agent's agreement to accept legal and official documents on behalf of the organization. This form must include the registered agent's name, address, and signature, ensuring compliance with state requirements for nonprofit certification. |

| 3 | Incorporator Statement | An Incorporator Statement is a crucial document required for a Nonprofit Incorporation Certificate, detailing the incorporator's name, address, and affirmation of intent to form the nonprofit organization. This statement must comply with state-specific regulations and often includes a declaration that the incorporator is authorized to execute the articles of incorporation. |

| 4 | Bylaws Adoption Certificate | A Bylaws Adoption Certificate is a crucial document required for nonprofit incorporation, serving as formal proof that the organization's bylaws have been duly adopted by the board of directors. This certificate ensures compliance with state regulations by confirming the establishment of governance rules, which is essential for obtaining the nonprofit incorporation certificate. |

| 5 | Initial Board of Directors Resolution | The Initial Board of Directors Resolution is a critical document required for obtaining a Nonprofit Incorporation Certificate, outlining the board's official approval of incorporation and key organizational decisions. This resolution typically includes authorization to file incorporation documents, appoint officers, and adopt bylaws, ensuring legal compliance and formal establishment of the nonprofit entity. |

| 6 | EIN Confirmation Letter | To obtain a nonprofit incorporation certificate, you need your EIN Confirmation Letter, which verifies your Employer Identification Number assigned by the IRS. This document is essential for tax identification and is required during the incorporation process to legally register your nonprofit organization. |

| 7 | 501(c)(3) Draft Narrative | To obtain a 501(c)(3) nonprofit incorporation certificate, you need key documents including the Articles of Incorporation, a detailed 501(c)(3) draft narrative outlining your organization's exempt purpose, bylaws, and a completed IRS Form 1023 or 1023-EZ. The draft narrative must clearly describe the charitable, religious, educational, or scientific mission to ensure compliance with IRS requirements for tax-exempt status. |

| 8 | Public Benefit Statement | The Public Benefit Statement is a crucial document required for a nonprofit incorporation certificate, outlining the specific social, charitable, or educational purpose the organization serves to benefit the public. This statement ensures compliance with state regulations and validates the nonprofit's mission in its foundational incorporation documents. |

| 9 | Conflict of Interest Policy Certificate | A Conflict of Interest Policy Certificate is a critical document required for nonprofit incorporation, demonstrating the organization's commitment to ethical governance and transparency. This certificate ensures board members disclose any potential conflicts, aligning with state regulations to maintain trust and compliance during the incorporation process. |

| 10 | Fiscal Sponsorship Agreement | For a Nonprofit Incorporation Certificate, you need a Fiscal Sponsorship Agreement that clearly outlines the relationship between the nonprofit and its fiscal sponsor, specifying financial management and compliance responsibilities. This document ensures oversight, accountability, and proper handling of funds during the initial phases of nonprofit development. |

Introduction to Nonprofit Incorporation Certificates

| Introduction to Nonprofit Incorporation Certificates |

|---|

| A Nonprofit Incorporation Certificate is a legal document that establishes a nonprofit organization as a recognized entity under state law. This certificate provides official verification that the nonprofit has been formed and registered, allowing it to operate, open bank accounts, enter into contracts, and apply for tax-exempt status. The certificate protects the organization's name and confirms its legal existence, offering credibility and trust to donors, partners, and the community. |

| Essential Documents Required for Obtaining a Nonprofit Incorporation Certificate |

|

| Significance of Accurate Documentation |

| Proper documentation ensures compliance with state laws and facilitates smooth processing of the incorporation certificate. Accurate filings reduce delays and provide a solid foundation for nonprofit governance and tax-exempt status applications. |

Importance of Incorporation for Nonprofit Organizations

Obtaining a nonprofit incorporation certificate is a critical step for establishing legal recognition and credibility. This process requires submitting specific documents that validate the organization's structure and purpose.

- Articles of Incorporation - These foundational documents formally create the nonprofit corporation and outline its mission and governance.

- Bylaws - Internal rules that govern the organization's operations, detailing member roles and decision-making processes.

- Board of Directors Information - Documentation listing the names and addresses of the initial board members responsible for organizational oversight.

Key Documents Required for Nonprofit Incorporation

Securing a nonprofit incorporation certificate requires preparing specific legal documents. These documents establish the organization's legal foundation and compliance with state regulations.

- Articles of Incorporation - Formal document filed with the state to legally create the nonprofit entity.

- Bylaws - Internal rules governing the nonprofit's operations and management structure.

- Board of Directors List - Names and addresses of initial board members responsible for governance.

- Conflict of Interest Policy - A statement outlining procedures to avoid conflicts within the organization.

- Registered Agent Information - Designated person or entity authorized to receive legal documents on behalf of the nonprofit.

Step-by-Step Nonprofit Incorporation Filing Process

Filing for a Nonprofit Incorporation Certificate requires specific documents to establish your organization legally. Knowing each document's role simplifies the nonprofit incorporation process effectively.

- Articles of Incorporation - This official document outlines your nonprofit's name, purpose, and structure.

- Bylaws - These internal rules govern your nonprofit's operations and board management.

- Employer Identification Number (EIN) Application - Required for tax identification and banking purposes.

Carefully preparing and submitting these documents according to your state's guidelines ensures successful nonprofit incorporation.

State-Specific Requirements for Nonprofit Incorporation

When applying for a nonprofit incorporation certificate, the required documents vary significantly by state. Understanding these state-specific requirements ensures a smooth application process and legal compliance.

Common documents include the Articles of Incorporation, which must align with state guidelines, and the nonprofit's bylaws. Some states also require a Certificate of Good Standing or a filing fee receipt to accompany the application.

Common Mistakes to Avoid During Incorporation

Obtaining a Nonprofit Incorporation Certificate requires specific documents such as Articles of Incorporation, a registered agent form, and bylaws. Proper preparation ensures a smooth submission process to state authorities.

Common mistakes include incomplete or inconsistent information across documents, neglecting to include the nonprofit's purpose, and failing to sign all required forms. Avoiding these errors prevents delays or rejections during incorporation. Double-checking each document for accuracy and compliance with state requirements is essential for successful certification.

Timeline and Processing of Incorporation Certificates

What documents are essential for obtaining a nonprofit incorporation certificate? Typically, you need articles of incorporation, a nonprofit bylaws document, and an application form submitted to the state agency. A federal Employer Identification Number (EIN) is often required to complete the process efficiently.

How long does the processing of a nonprofit incorporation certificate usually take? The timeline varies by state but generally ranges from 2 to 8 weeks after submitting all required documents. Expedited processing options may be available for an additional fee, significantly reducing wait times.

Post-Incorporation Compliance Obligations

Obtaining a Nonprofit Incorporation Certificate requires submitting foundational documents such as Articles of Incorporation, a registered agent's details, and initial director information. Post-incorporation, compliance obligations include filing annual reports, maintaining financial records, and adhering to state and federal tax regulations. Meeting these document and reporting requirements ensures your nonprofit remains in good standing with regulatory authorities.

Maintaining Good Standing: Ongoing Reporting and Filings

Obtaining a Nonprofit Incorporation Certificate requires submitting essential documents such as Articles of Incorporation, bylaws, and a completed application form to the state. These documents establish your nonprofit's legal identity and outline its purpose and governance structure.

Maintaining good standing for your nonprofit involves ongoing reporting and timely filings, including annual reports and financial disclosures. Compliance with state requirements ensures the nonprofit remains active and retains its tax-exempt status.

What Documents Do You Need for a Nonprofit Incorporation Certificate? Infographic