Small business owners need several key documents to complete an EIN application, including their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), business formation documents such as Articles of Incorporation or a partnership agreement, and a valid mailing address for the business. If the business operates as a sole proprietorship with no employees, the owner's personal information must be provided. Accurate information about the business type, ownership, and start date is essential to ensure smooth IRS processing of the EIN application.

What Documents Do Small Business Owners Need for EIN Application?

| Number | Name | Description |

|---|---|---|

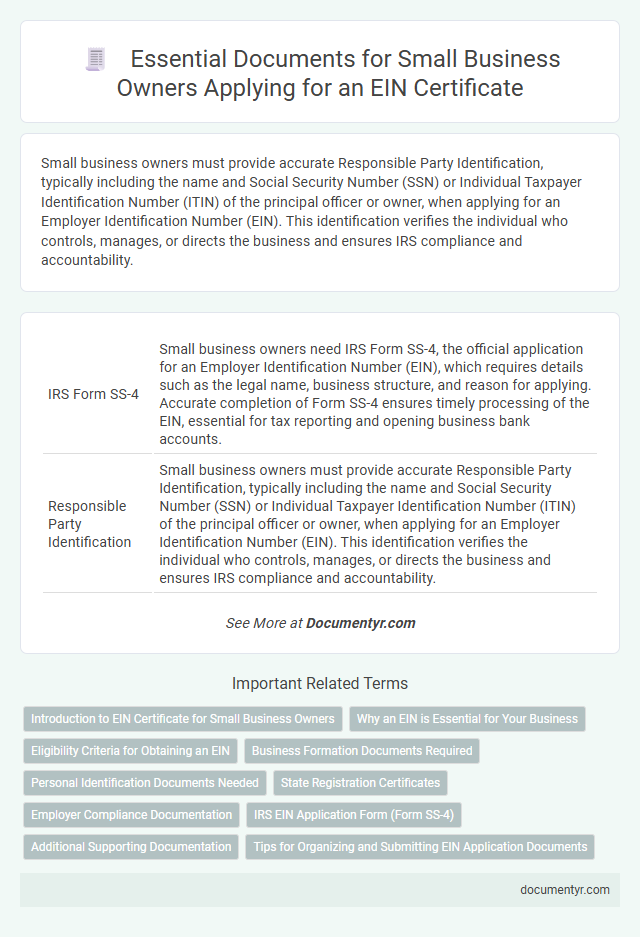

| 1 | IRS Form SS-4 | Small business owners need IRS Form SS-4, the official application for an Employer Identification Number (EIN), which requires details such as the legal name, business structure, and reason for applying. Accurate completion of Form SS-4 ensures timely processing of the EIN, essential for tax reporting and opening business bank accounts. |

| 2 | Responsible Party Identification | Small business owners must provide accurate Responsible Party Identification, typically including the name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) of the principal officer or owner, when applying for an Employer Identification Number (EIN). This identification verifies the individual who controls, manages, or directs the business and ensures IRS compliance and accountability. |

| 3 | Third-Party Designee Authorization | Small business owners applying for an EIN must complete IRS Form SS-4 and may include a Third-Party Designee Authorization on the application to allow an authorized individual to receive and answer questions about the EIN. This designation requires providing the designee's name, phone number, and fax number or email address, ensuring streamlined communication with the IRS during the EIN assignment process. |

| 4 | Domestic Entity EIN Certification | Small business owners applying for a Domestic Entity EIN certification must provide key documents such as the Articles of Organization or Incorporation, a valid taxpayer identification number (SSN or ITIN) for the responsible party, and a completed Form SS-4 application. Supporting documentation may also include state-issued business licenses or certificates of good standing to verify the legal existence of the entity. |

| 5 | Business Formation Documents | Small business owners must provide key business formation documents such as Articles of Incorporation, partnership agreements, or a DBA certificate when applying for an EIN. These documents verify the legal structure and existence of the business required by the IRS. |

| 6 | State Registration Certificate | Small business owners must include their State Registration Certificate among required documents when applying for an EIN, as it verifies their legal status and business name within the state. This certificate ensures eligibility and streamlines the IRS EIN issuance process. |

| 7 | Digital Signature Attestation | Small business owners applying for an EIN must prepare key documents including their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), business formation documents, and a valid Digital Signature Attestation to verify the authenticity of the application electronically. The Digital Signature Attestation ensures secure and legally binding authentication, streamlining the IRS EIN application process and preventing identity fraud. |

| 8 | Applicant Verification Documents | Small business owners need to provide applicant verification documents such as a valid government-issued ID, Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN) when applying for an Employer Identification Number (EIN). These documents confirm the identity of the responsible party to the IRS and are essential for processing the EIN application accurately. |

| 9 | Legal Structure Definition Papers | Small business owners must provide legal structure definition papers such as Articles of Incorporation for corporations, Articles of Organization for LLCs, or partnership agreements when applying for an EIN. These documents confirm the business entity type and are essential for accurate IRS classification and tax processing. |

| 10 | Online EIN Confirmation Letter | Small business owners need key documents such as their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), business formation documents, and ownership details to apply for an EIN. After applying online, the EIN Confirmation Letter is issued instantly, serving as the official proof of EIN assignment required for tax filings, opening bank accounts, and hiring employees. |

Introduction to EIN Certificate for Small Business Owners

Obtaining an Employer Identification Number (EIN) is essential for small business owners to legally operate and manage tax responsibilities. The EIN serves as a unique identifier for a business entity in the United States.

Small business owners must prepare specific documents when applying for an EIN to ensure a smooth and timely process. Key documents typically include the business formation details, owner identification, and a completed IRS application form.

Why an EIN is Essential for Your Business

Obtaining an Employer Identification Number (EIN) is crucial for small business owners to establish their business identity with the IRS. An EIN enables smooth tax filing, hiring employees, and opening business bank accounts.

- Legal Identification - An EIN uniquely identifies your business for tax reporting and regulatory purposes.

- Tax Compliance - The EIN ensures your business meets federal tax obligations efficiently and accurately.

- Business Operations - It is necessary for hiring employees, applying for business licenses, and opening financial accounts.

Eligibility Criteria for Obtaining an EIN

Small business owners must meet specific eligibility criteria to obtain an Employer Identification Number (EIN). Proper documentation is essential to prove identity and business legitimacy during the application process.

- Valid Taxpayer Identification Number (TIN) - Applicants must provide a Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or another valid TIN.

- Business Structure Documentation - Proof of the business type such as sole proprietorship, partnership, corporation, or LLC must be submitted.

- Legal Business Formation Records - Documentation like Articles of Incorporation or Partnership Agreements are required to confirm the entity's formal existence.

Meeting these eligibility requirements ensures a smooth EIN application process for small business owners.

Business Formation Documents Required

When applying for an EIN, small business owners must provide specific business formation documents to verify their entity. These documents establish the legal structure and legitimacy of the business.

Essential business formation documents include the Articles of Incorporation for corporations, the Articles of Organization for LLCs, and partnership agreements for partnerships. Sole proprietors typically need to provide a business license or a DBA (Doing Business As) certificate. These documents help the IRS confirm the identity and structure of the business during the EIN application process.

Personal Identification Documents Needed

| Document Type | Description |

|---|---|

| Social Security Number (SSN) | Essential for verifying identity; must be valid and current for the person applying for the EIN. |

| Individual Taxpayer Identification Number (ITIN) | Accepted if an SSN is not available; used primarily by non-resident aliens or others without an SSN. |

| Valid Government-Issued Photo ID | Includes driver's license, passport, or state ID to confirm personal identification when required. |

| Foreign Passport (if applicable) | Required for those without a U.S. SSN or ITIN and for non-U.S. residents applying for an EIN. |

State Registration Certificates

State Registration Certificates are essential documents when applying for an Employer Identification Number (EIN). These certificates prove your business is legally registered within the state where it operates.

- Business License - Verifies that your business has the proper authorization to operate at the state level.

- Articles of Incorporation - Provides official confirmation of your company's formation and legal existence.

- Certificate of Good Standing - Demonstrates that your business complies with state requirements and is up-to-date on filings and fees.

Employer Compliance Documentation

Small business owners must prepare specific employer compliance documentation when applying for an EIN. Essential documents include the business's formation papers, such as Articles of Incorporation or a Partnership Agreement. The IRS also requires a valid Social Security Number or Individual Taxpayer Identification Number from the responsible party to complete the EIN application.

IRS EIN Application Form (Form SS-4)

Small business owners must complete the IRS EIN Application Form (Form SS-4) to obtain an Employer Identification Number (EIN). This form requires essential information about the business, including the legal name, address, and type of entity. Accurate submission of Form SS-4 is crucial for tax reporting and compliance with IRS regulations.

Additional Supporting Documentation

What additional supporting documentation do small business owners need for an EIN application?

Small business owners may need to provide documents such as a formation certificate, partnership agreement, or articles of incorporation to verify their business structure. Identification documents like a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) for the responsible party may also be required to complete the EIN application.

What Documents Do Small Business Owners Need for EIN Application? Infographic