To open a bank account for a minor, essential documents include the minor's birth certificate to verify age and identity, along with the guardian's valid identification such as a passport or driver's license. Proof of address for both the minor and guardian, such as a utility bill or bank statement, is also required. Some banks may request a certificate of guardianship or a notarized consent form to confirm the guardian's legal authority.

What Documents Are Required for Opening a Bank Account for a Minor?

| Number | Name | Description |

|---|---|---|

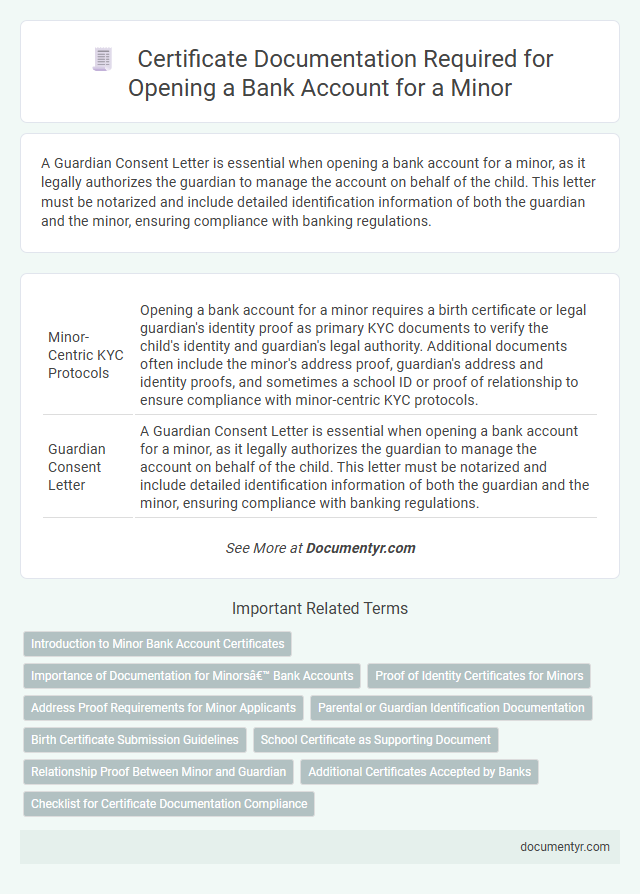

| 1 | Minor-Centric KYC Protocols | Opening a bank account for a minor requires a birth certificate or legal guardian's identity proof as primary KYC documents to verify the child's identity and guardian's legal authority. Additional documents often include the minor's address proof, guardian's address and identity proofs, and sometimes a school ID or proof of relationship to ensure compliance with minor-centric KYC protocols. |

| 2 | Guardian Consent Letter | A Guardian Consent Letter is essential when opening a bank account for a minor, as it legally authorizes the guardian to manage the account on behalf of the child. This letter must be notarized and include detailed identification information of both the guardian and the minor, ensuring compliance with banking regulations. |

| 3 | Birth Certificate Authentication | Opening a bank account for a minor typically requires a birth certificate authentication to verify the child's identity and age, ensuring compliance with banking regulations. The authenticated birth certificate serves as a primary document alongside identification of the guardian or parent responsible for the account. |

| 4 | Legal Custodianship Affidavit | A Legal Custodianship Affidavit is essential for opening a bank account for a minor, serving as proof that a guardian or custodian is authorized to manage the child's finances. Banks typically require this affidavit alongside the minor's birth certificate and identification to ensure compliance with legal and regulatory standards. |

| 5 | Parental PAN Card Linkage | When opening a bank account for a minor, submission of the minor's birth certificate along with the parent or guardian's PAN card is mandatory to establish identity and legal guardianship. Linking the parent's PAN card ensures compliance with financial regulations and facilitates tax-related reporting for transactions conducted via the minor's account. |

| 6 | E-signature Authorization for Minors | E-signature authorization for minors typically requires a parent or legal guardian's digital consent documented alongside the minor's identification, such as a birth certificate or passport, and proof of guardianship. Banks may also request a notarized consent form or a digital verification process compliant with relevant financial regulations to ensure lawful authorization. |

| 7 | Nominee Declaration Form | A Nominee Declaration Form is essential when opening a bank account for a minor, designating a person to receive funds in case of the minor's untimely demise. This document ensures legal clarity and smooth fund transfer, protecting the minor's financial interests. |

| 8 | Guardian Aadhaar Seeding | Opening a bank account for a minor requires the guardian's valid Aadhaar card for identity verification and seamless Aadhaar seeding, ensuring compliance with KYC norms and linking the account to the official biometric database. Guardians must also provide the minor's birth certificate and a recent photograph to complete the documentation process efficiently. |

| 9 | Age-Verification Timestamp | Proof of age and identity, such as a birth certificate or passport, must be submitted to satisfy the age-verification timestamp required for opening a minor's bank account. Banks often require a government-issued document that includes the date of birth to validate the minor's eligibility and comply with regulatory standards. |

| 10 | Safe-Keep Mandate Certificate | A Safe-Keep Mandate Certificate is a crucial document required for opening a bank account for a minor, ensuring the appointed guardian or custodian is legally authorized to operate the account on the minor's behalf. This certificate must be accompanied by the minor's birth certificate, proof of identity and address of the guardian, and the guardian's KYC documents to comply with banking regulations. |

Introduction to Minor Bank Account Certificates

Opening a bank account for a minor requires specific documents to ensure proper authorization and compliance with banking regulations. A minor bank account certificate is a crucial document that verifies the minor's eligibility and the guardian's consent.

This certificate helps the bank maintain accurate records and safeguards the financial interests of the minor. Understanding the necessary documentation streamlines the account opening process for guardians and banking institutions alike.

Importance of Documentation for Minors’ Bank Accounts

Opening a bank account for a minor requires specific documents to ensure legal compliance and secure financial management. Proper documentation safeguards both the minor's interests and the bank's responsibilities.

- Proof of Identity of the Minor - Documents like a birth certificate or passport establish the minor's identity and age.

- Guardian's Identification - Valid ID of the parent or guardian is essential for authorization and control of the account.

- Proof of Address - Utility bills or official letters confirm the residential address linked to both the minor and guardian.

Proof of Identity Certificates for Minors

Opening a bank account for a minor requires valid proof of identity certificates to verify the child's identity. Commonly accepted documents include the minor's birth certificate, passport, or government-issued ID card. These certificates serve as official verification, ensuring compliance with banking regulations and safeguarding the minor's account.

Address Proof Requirements for Minor Applicants

Opening a bank account for a minor requires specific documents, including valid address proof. Acceptable address proofs must reflect the minor's or guardian's current residential address.

Documents such as a utility bill, bank statement, or Aadhaar card can serve as valid address proof. In cases where the minor does not have independent address documents, the guardian's address proof is accepted. The address proof must be recent and clearly show the name and address to ensure compliance with bank regulations.

Parental or Guardian Identification Documentation

Opening a bank account for a minor requires specific identification documentation from the parent or guardian. These documents verify the adult's authority to manage the account on behalf of the minor.

- Government-issued ID - A valid passport, driver's license, or national ID card is required to confirm identity.

- Proof of Guardianship - Legal documents such as a birth certificate or court order establish parental or guardian rights.

- Address Verification - Utility bills, bank statements, or other official correspondence validate the current residential address.

Birth Certificate Submission Guidelines

Opening a bank account for a minor requires submitting specific documents, with the birth certificate being a primary requirement. The birth certificate serves as proof of identity and age, verifying the minor's eligibility for the account.

When submitting the birth certificate, ensure it is the original document or a certified copy as required by the bank. You may need to present it along with valid identification for the guardian or parent opening the account.

School Certificate as Supporting Document

| Document | Purpose | Details |

|---|---|---|

| School Certificate | Proof of Age and Identity | The school certificate serves as a valid supporting document to establish the minor's age and identity. It must be issued by the educational institution and include the minor's full name, date of birth, and enrollment details. This certificate helps banks verify eligibility and maintain compliance with KYC (Know Your Customer) regulations. |

| Birth Certificate | Legal Age Verification | Official birth records provide a legal declaration of the minor's birth date. This document complements the school certificate in confirming the minor's age for opening an account. |

| Parent/Guardian ID Proof | Authorization and Responsibility | Valid government-issued identification of the parent or guardian is mandatory to authorize the minor's account opening and manage account operations. |

| Address Proof | Residential Verification | Current address proof, such as utility bills or rental agreements, is required to verify the residential address of the minor or parent/guardian. |

Your bank may specifically request the school certificate among these documents to ensure a smooth and compliant account opening process for minors.

Relationship Proof Between Minor and Guardian

What documents are required to prove the relationship between a minor and their guardian when opening a bank account? The primary document accepted is a legal guardian certificate or custody papers issued by a competent authority. Birth certificates linking the minor to the guardian are also commonly required to establish clear parental or guardianship ties.

Additional Certificates Accepted by Banks

When opening a bank account for a minor, banks typically require the child's birth certificate as primary identification. Additional certificates accepted by banks include the minor's school ID, guardianship certificate, or a government-issued identification card. Your submission of these documents ensures proper verification and smooth account setup.

What Documents Are Required for Opening a Bank Account for a Minor? Infographic