To obtain a Joint Bank Account Closure Certificate, submit the original passbook or checkbook, valid identity proofs of all account holders, and the duly signed account closure request form. Additionally, provide a No Objection Certificate (NOC) from all joint account holders to confirm unanimous consent. Some banks may also require the submission of KYC documents and a copy of the joint account agreement.

What Documents are Required for Joint Bank Account Closure Certificate?

| Number | Name | Description |

|---|---|---|

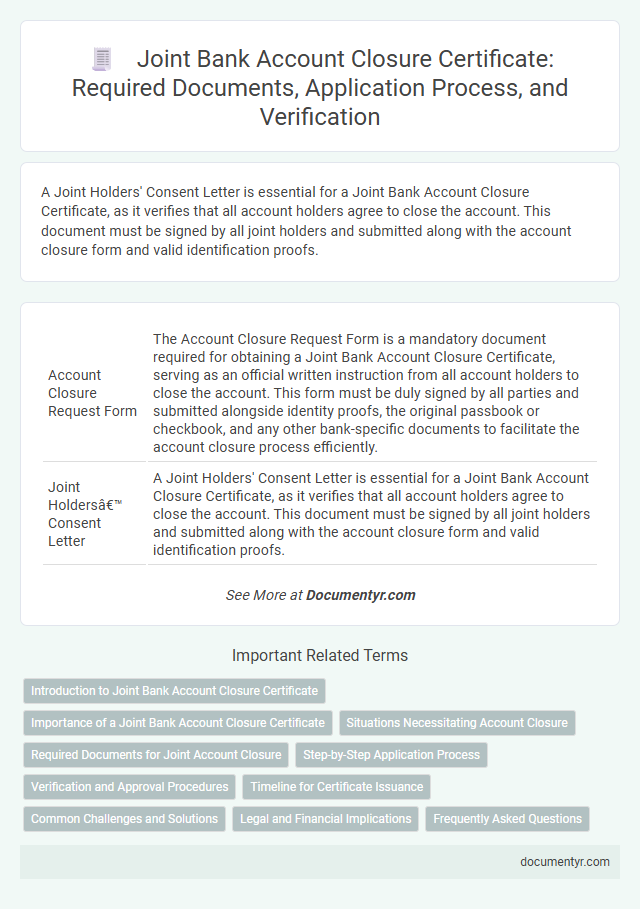

| 1 | Account Closure Request Form | The Account Closure Request Form is a mandatory document required for obtaining a Joint Bank Account Closure Certificate, serving as an official written instruction from all account holders to close the account. This form must be duly signed by all parties and submitted alongside identity proofs, the original passbook or checkbook, and any other bank-specific documents to facilitate the account closure process efficiently. |

| 2 | Joint Holders’ Consent Letter | A Joint Holders' Consent Letter is essential for a Joint Bank Account Closure Certificate, as it verifies that all account holders agree to close the account. This document must be signed by all joint holders and submitted along with the account closure form and valid identification proofs. |

| 3 | KYC Compliance Certificates | Joint bank account closure requires submission of original KYC compliance certificates like Aadhaar card, PAN card, and address proof alongside the joint account closure application form. Banks may also ask for a notarized affidavit and the signatures of all account holders to ensure identification verification and regulatory adherence. |

| 4 | Original Passbook Surrender Acknowledgment | To obtain a Joint Bank Account Closure Certificate, submission of the Original Passbook Surrender Acknowledgment is essential as it serves as proof that the physical passbook has been returned to the bank. Alongside this, valid identification documents and a jointly signed closure request form are typically required to complete the closure process. |

| 5 | Unused Cheque Leaves Declaration | To obtain a Joint Bank Account Closure Certificate, the account holders must submit a formal Unused Cheque Leaves Declaration along with identity proofs such as Aadhaar card, PAN card, and the original passbook or bank statement. The Unused Cheque Leaves Declaration confirms the surrender or non-possession of any cheques from the closed account, ensuring clear closure records. |

| 6 | Digital Signature Verification Proof | For a Joint Bank Account Closure Certificate, documents required typically include valid identity proofs of all account holders, a joint account closure request form, and a Digital Signature Verification Proof to authenticate the consent of each party electronically. The Digital Signature Verification Proof ensures secure, legally binding confirmation of the account closure authorization from all joint holders in compliance with banking regulations. |

| 7 | FATCA/CRS Self-Certification | The Joint Bank Account Closure Certificate requires submission of valid identification documents, the joint account closure request form, and a duly signed FATCA/CRS Self-Certification form to comply with regulatory tax reporting obligations. The FATCA/CRS Self-Certification verifies the tax residency status of all account holders, ensuring adherence to global anti-money laundering and tax compliance standards. |

| 8 | Relationship Termination Authorization | To obtain a Joint Bank Account Closure Certificate, submission of identity proofs of both account holders and a formal Relationship Termination Authorization signed by all parties is essential. This authorization document explicitly confirms mutual consent to close the account, preventing future disputes over account status. |

| 9 | Beneficial Owner Disclosure Certificate | To obtain a Joint Bank Account Closure Certificate, submitting a Beneficial Owner Disclosure Certificate is mandatory to verify the identity and ownership details of all account holders. This document ensures compliance with regulatory requirements by listing all individuals with significant control or ownership in the joint account. |

| 10 | Nomination Withdrawal Confirmation | The Nomination Withdrawal Confirmation is a crucial document required for the closure of a joint bank account certificate, ensuring that any previously nominated beneficiary is officially deregistered. This confirmation must be submitted alongside identity proofs and the joint account closure application to process the certificate efficiently. |

Introduction to Joint Bank Account Closure Certificate

A Joint Bank Account Closure Certificate is an official document verifying the closure of a joint bank account. It serves as proof that all account activities have been settled and the account is no longer active.

- Account Holder Identification - Government-issued ID proofs such as PAN card, Aadhaar card, or passport for all account holders are required.

- Joint Account Closure Request Form - A signed application from all account holders requesting the closure must be submitted.

- Bank Passbook and Chequebooks - These documents need to be surrendered to the bank during the closure process.

You must ensure that you provide all necessary documents to complete the joint bank account closure efficiently.

Importance of a Joint Bank Account Closure Certificate

A Joint Bank Account Closure Certificate serves as official proof that a joint bank account has been successfully closed and all parties have agreed to the closure. This document is crucial for record-keeping and resolving any future disputes regarding the joint account.

To obtain this certificate, key documents are required including valid identity proofs of all account holders, the original passbook or checkbook, and the joint account closure request form signed by all parties. Banks may also ask for a no-dues certificate to confirm that all pending dues and charges have been settled.

Situations Necessitating Account Closure

Situations necessitating a joint bank account closure often include the death of one account holder, account inactivity, or mutual agreement between account holders to terminate the account. Required documents typically consist of the original joint account closure form, valid identity proofs of all account holders such as Aadhaar or passport, and the bank passbook or cheque book. In cases involving a deceased account holder, a death certificate and legal documents like succession certificates or probate may be mandatory for completing the closure process.

Required Documents for Joint Account Closure

To obtain a Joint Bank Account Closure Certificate, you must submit specific documents as proof of identity and consent from all account holders. Primary documents include valid photo identification such as passports, driving licenses, or Aadhaar cards.

The bank also requires the original joint account passbook or cheque book along with a formal joint account closure request signed by all parties. Any outstanding loan clearance or debit settlement documents may be necessary for verification before processing the closure certificate.

Step-by-Step Application Process

What documents are required for a joint bank account closure certificate? You need the original joint account closure application form signed by all account holders. Submit valid identity proofs such as Aadhaar cards or passports for each account holder to verify identities.

How do you begin the joint bank account closure certificate application process? First, collect all necessary documents including the signed closure form and identity proofs. Ensure that all joint account holders provide their consent by signing the application form.

What is the next step after gathering the required documents? Visit your bank branch where the joint account is held and submit the closure application along with the documents. The bank officer will verify all submissions before processing the request.

How long does the bank take to issue the joint account closure certificate? Typically, the certificate is issued within 7 to 10 business days after successful verification. You can request the bank to notify you once the certificate is ready for collection.

Are there any additional steps for joint account holders regarding the closure certificate? Each joint account holder should confirm that their signature is present on the application to avoid delays. Keeping a copy of the submitted documents helps in case of discrepancies or follow-ups.

Verification and Approval Procedures

| Document Name | Purpose | Verification Procedure | Approval Procedure |

|---|---|---|---|

| Joint Account Closure Request Form | Official request to close the joint bank account | Verify signatures of all account holders against bank records | Bank official reviews and approves after identity confirmation |

| Identity Proof of Account Holders | Confirm identities of all joint account holders | Check valid government-issued photo IDs such as Passport, Aadhaar card, or Driving licence | Validation by bank's KYC (Know Your Customer) team |

| Account Passbook/Statement | Verify account details and confirm balance before closure | Cross-check recent transaction records and balance with bank system | Authorized officer approves closure only if account balance is settled |

| No Objection Certificate (NOC) from all account holders | Confirms consent from all parties for account closure | Verify signatures, date, and agreement of all joint holders | Approval obtained only after receiving NOC from every account holder |

| Cheque Book and Debit/Credit Cards | Submit all unused items for proper account closure | Cross-check with bank records for issued instruments | Bank official confirms surrender and approves closure process |

| Address Proof of Account Holders | Confirm current address for record updating and verification | Check valid recent utility bills, Passport, or government-issued documents | Approval after address verification by compliance team |

| Authorization Letter (if applicable) | Granted when one joint holder authorizes another to act on their behalf | Verify letter authenticity and identity of authorized person | Requires additional approval from higher bank authority |

Timeline for Certificate Issuance

To obtain a Joint Bank Account Closure Certificate, specific documents must be submitted to the bank. The timeline for certificate issuance depends on the bank's processing procedures and completeness of submitted documents.

- Account Holder Identity Proof - Valid government-issued IDs of all account holders are required to verify identities before processing the closure certificate.

- Joint Account Closure Request Form - A duly signed form by all account holders must be submitted to initiate the closure process.

- Timeline for Certificate Issuance - Most banks issue the closure certificate within 7 to 15 business days after receiving all required documents and completing account settlement.

Common Challenges and Solutions

Closing a joint bank account requires submitting specific documents, including the account holder's identification proof, the joint account closure request form, and the original passbook or checkbook. Banks often mandate a No Objection Certificate (NOC) signed by all account holders to proceed with the closure.

Common challenges include delays due to missing signatures and incomplete document submissions, which can halt the closure process. Disputes between account holders or unclear instructions from banks add complexity. Solutions involve verifying all signatures beforehand, maintaining clear communication among co-holders, and consulting the bank's checklist to ensure all paperwork is properly completed.

Legal and Financial Implications

Closing a joint bank account requires specific documents to ensure legal compliance and protect financial interests. Proper documentation avoids disputes and confirms that all parties agree to the closure.

- Account Holder Identification - Valid government-issued IDs of all joint account holders must be submitted to verify identities legally.

- Joint Account Closure Request Form - A signed application by all account holders is necessary to authorize the closure officially.

- Bank Passbook or Checkbook - Returning these documents ensures the account is fully settled and closed without pending transactions.

What Documents are Required for Joint Bank Account Closure Certificate? Infographic