To complete a FAFSA application, you need several key documents including your Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. If you are a dependent student, you will also need your parents' financial information and Social Security numbers. Having these documents ready ensures accurate submission and avoids delays in processing your financial aid.

What Documents are Needed for FAFSA Application?

| Number | Name | Description |

|---|---|---|

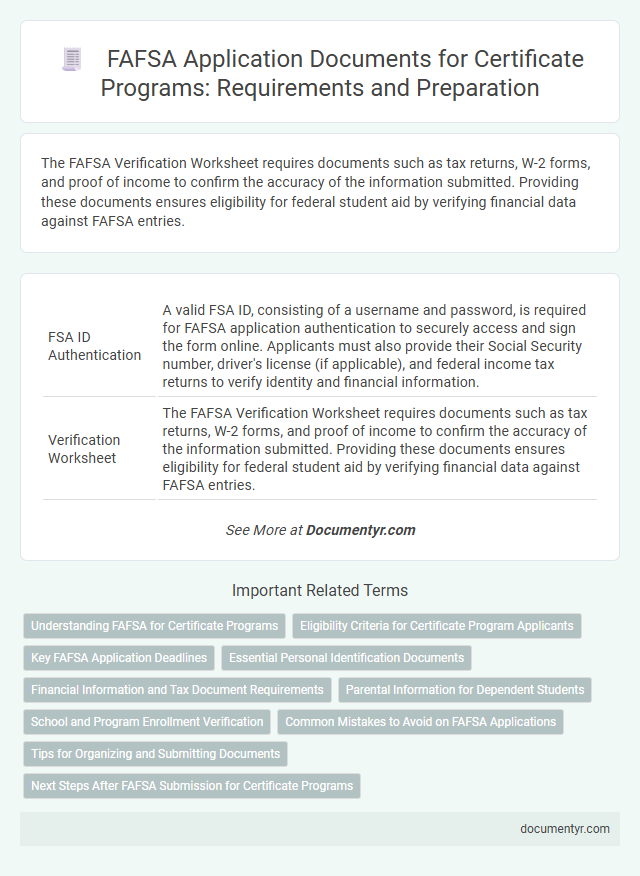

| 1 | FSA ID Authentication | A valid FSA ID, consisting of a username and password, is required for FAFSA application authentication to securely access and sign the form online. Applicants must also provide their Social Security number, driver's license (if applicable), and federal income tax returns to verify identity and financial information. |

| 2 | Verification Worksheet | The FAFSA Verification Worksheet requires documents such as tax returns, W-2 forms, and proof of income to confirm the accuracy of the information submitted. Providing these documents ensures eligibility for federal student aid by verifying financial data against FAFSA entries. |

| 3 | Asset Documentation | FAFSA asset documentation requires bank statements, investment account records, and real estate appraisals to verify financial resources. Accurate reporting of cash, savings, stocks, bonds, and other assets ensures eligibility for federal student aid programs. |

| 4 | Dependency Override Letter | A Dependency Override Letter is required for FAFSA applicants who do not meet the standard dependency criteria but have special circumstances, such as abuse or abandonment, verified by a financial aid administrator. Additional documents may include court orders, letters from social workers, or other professional statements that support the request for a dependency status change. |

| 5 | Selective Service Status Proof | FAFSA applications require proof of Selective Service registration for male applicants aged 18 to 25, which can be verified through a Selective Service registration acknowledgment letter or confirmation number. Without this documentation, eligibility for federal student aid may be denied, emphasizing the importance of submitting accurate Selective Service status proof. |

| 6 | Special Circumstances Letter | A Special Circumstances Letter is required for FAFSA applications when applicants face unique financial situations not reflected in standard forms, such as loss of income or unusual expenses. This letter must detail the circumstances and include supporting documentation like termination notices, medical bills, or other relevant evidence to ensure accurate financial assessment. |

| 7 | Non-Filing Statement | The FAFSA application requires a Non-Filing Statement from the IRS if the student or parent did not file a federal tax return for the relevant tax year. This document verifies the non-filing status and must be obtained directly from the IRS to complete the FAFSA accurately. |

| 8 | SNAP Benefits Documentation | FAFSA applicants receiving SNAP benefits must provide official documentation such as a benefits verification letter or an approval notice from the SNAP agency as proof of participation. Including these documents ensures eligibility for certain federal aid programs tied to income assistance verification. |

| 9 | Untaxed Income Statement | The FAFSA application requires an Untaxed Income Statement to verify financial information not reported on tax returns, such as child support received or untaxed Social Security benefits. Providing accurate documentation of untaxed income ensures proper assessment of financial aid eligibility and maximizes scholarship and grant opportunities. |

| 10 | Homelessness Determination Letter | A Homelessness Determination Letter is a crucial document for FAFSA applications, serving as official proof of a student's homeless or at-risk status when parental information is unavailable. This letter must be issued by a school district homeless liaison, the director of a homeless shelter, or a financial aid administrator to ensure eligibility for independent student status and access to federal financial aid. |

Understanding FAFSA for Certificate Programs

Understanding the documents required for a FAFSA application is crucial for students pursuing certificate programs. Proper preparation ensures a smooth financial aid process and timely access to funding.

- Proof of Identity - A valid Social Security number or alien registration number establishes eligibility for federal student aid.

- Income Information - Recent tax returns or W-2 forms from the student and parents are necessary to determine financial need accurately.

- Enrollment Details - Documentation from the certificate program verifying enrollment status helps confirm qualification for aid distribution.

Eligibility Criteria for Certificate Program Applicants

To apply for FAFSA as a certificate program applicant, you need to provide your Social Security number, your federal income tax returns, and your driver's license if you have one. Eligibility criteria require that the certificate program is accredited and leads to a recognized credential or industry certification. You must also be enrolled or accepted for enrollment in an eligible program at a participating institution to qualify for financial aid.

Key FAFSA Application Deadlines

To complete the FAFSA application, you need your Social Security number, driver's license, and federal income tax returns. Additional documents include W-2 forms, records of untaxed income, and bank statements.

Meeting FAFSA key deadlines is crucial to secure maximum financial aid opportunities. Deadlines vary by state and school, so check the official FAFSA website and your college's financial aid office early.

Essential Personal Identification Documents

Essential personal identification documents are required for the FAFSA application process to verify your identity. These include a valid Social Security card, a government-issued photo ID such as a driver's license or passport, and your birth certificate. Providing accurate and up-to-date documents ensures smooth processing of your financial aid request.

Financial Information and Tax Document Requirements

What financial documents are needed for a FAFSA application? The FAFSA requires applicants to provide accurate financial information to determine eligibility for federal student aid. Key documents include tax returns, W-2 forms, and records of untaxed income.

Which tax documents must be submitted for FAFSA verification? The FAFSA process primarily uses the IRS tax return transcript or a signed copy of the federal tax return. Applicants may also need recent W-2 forms and other income verification documents depending on their financial situation.

Parental Information for Dependent Students

Completing the FAFSA application requires gathering specific parental documents when applying as a dependent student. Providing accurate parental information is crucial for determining your eligibility for federal financial aid.

- Parental Tax Returns - Collect the most recent federal income tax returns of both parents to verify income and tax information.

- Social Security Numbers - Parents' Social Security Numbers must be included to confirm identity and eligibility.

- Household Information - Document the number of people living in the household and those attending college to calculate the Expected Family Contribution accurately.

School and Program Enrollment Verification

When applying for FAFSA, verifying school and program enrollment is essential to confirm eligibility for financial aid. This process requires specific documents that prove you are registered and attending an eligible institution and program.

Key documents include an enrollment verification form provided by your school's registrar or financial aid office. A copy of your admission letter or proof of current registration also supports your application. These documents ensure the Department of Education accurately assesses your FAFSA application for aid distribution.

Common Mistakes to Avoid on FAFSA Applications

Submitting your FAFSA application requires specific documents, including your Social Security number, federal income tax returns, and records of untaxed income. Accurate information ensures a smooth application process and maximizes your chances for financial aid.

Common mistakes to avoid on FAFSA applications include entering incorrect Social Security numbers and misreporting income details. Double-checking your data before submission prevents delays and potential loss of aid eligibility.

Tips for Organizing and Submitting Documents

Submitting your FAFSA application requires careful organization of essential documents to ensure accuracy and timeliness. Proper preparation can streamline the process and prevent common errors that delay financial aid consideration.

- Gather all identification documents - Have your Social Security number, driver's license, and alien registration number ready for verification purposes.

- Collect financial records - Prepare recent tax returns, W-2 forms, and records of untaxed income to accurately report financial information.

- Create a dedicated folder - Use a physical or digital folder to organize and store all required documents for easy access during application submission.

Maintain copies of your submitted FAFSA and supporting documents for future reference and updates.

What Documents are Needed for FAFSA Application? Infographic