To obtain student loan authorization, essential documents include a valid government-issued ID, proof of enrollment or acceptance letter from the educational institution, and a completed loan application form. Financial documents such as income statements or tax returns may be required to assess eligibility and repayment ability. Lenders might also request a credit report and cosigner information depending on the loan type and applicant's credit history.

What Documents are Necessary for Student Loan Authorization?

| Number | Name | Description |

|---|---|---|

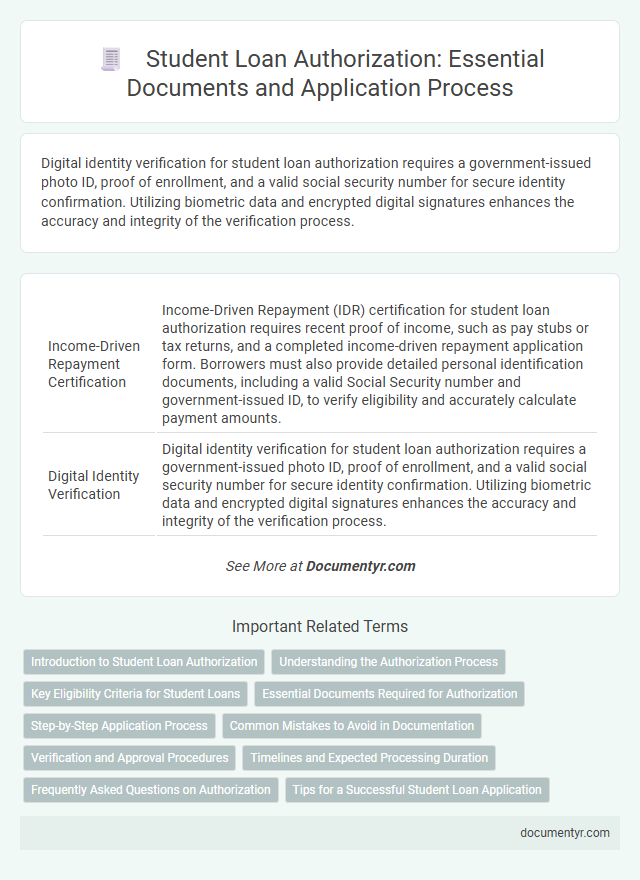

| 1 | Income-Driven Repayment Certification | Income-Driven Repayment (IDR) certification for student loan authorization requires recent proof of income, such as pay stubs or tax returns, and a completed income-driven repayment application form. Borrowers must also provide detailed personal identification documents, including a valid Social Security number and government-issued ID, to verify eligibility and accurately calculate payment amounts. |

| 2 | Digital Identity Verification | Digital identity verification for student loan authorization requires a government-issued photo ID, proof of enrollment, and a valid social security number for secure identity confirmation. Utilizing biometric data and encrypted digital signatures enhances the accuracy and integrity of the verification process. |

| 3 | E-signature Consent Form | The E-signature Consent Form is a critical document required for student loan authorization, allowing borrowers to electronically sign loan agreements and disclosures in compliance with federal regulations. This form ensures legal validity of digital signatures and streamlines the loan processing timeline by enabling secure, paperless transactions. |

| 4 | FAFSA SAR (Student Aid Report) | The FAFSA Student Aid Report (SAR) is a critical document required for student loan authorization, containing a summary of the information submitted on the FAFSA application and providing eligibility details for federal student aid. Lenders and loan servicers use the FAFSA SAR to verify financial need and confirm enrollment status, making it essential for processing and approving student loans. |

| 5 | Blockchain Credential Transcript | Student loan authorization requires a blockchain credential transcript that verifies academic records with tamper-proof encryption, ensuring authenticity and secure access. This digital document streamlines the verification process, reducing fraud risks and expediting loan approval. |

| 6 | Parental PLUS Loan Endorsement | To obtain student loan authorization for a Parental PLUS Loan Endorsement, parents must provide a completed loan application, proof of identity, and a valid credit check authorization. Supporting documents typically include parental income verification, tax returns, and a signed Master Promissory Note (MPN) specific to the PLUS loan requirements. |

| 7 | COA (Cost of Attendance) Breakdown | The Cost of Attendance (COA) breakdown is essential for student loan authorization, detailing tuition, fees, room and board, books, supplies, and personal expenses. Accurate COA documentation ensures lenders assess the total financial need before approving the loan amount. |

| 8 | Loan Entrance Counseling Confirmation | Loan entrance counseling confirmation is essential for student loan authorization, ensuring borrowers understand their repayment obligations and loan terms. Documents required include proof of completed online counseling, a government-issued ID, and the loan application form submitted to the lender. |

| 9 | Hybrid Enrollment Verification | For student loan authorization with hybrid enrollment verification, essential documents include a current enrollment certification from the educational institution indicating both in-person and online coursework, along with a valid government-issued ID to confirm student identity. Financial aid officers may also require academic transcripts and proof of residency to validate eligibility and enrollment status. |

| 10 | AI-powered Document Validation | AI-powered document validation requires submission of government-issued identification, proof of enrollment, and income verification documents to ensure accurate student loan authorization. Advanced algorithms analyze these documents in real-time, enhancing security and expediting the approval process. |

Introduction to Student Loan Authorization

Student loan authorization is a critical step in securing financial aid for education. It involves verifying eligibility and approving the loan application based on specific documentation. Understanding the required documents streamlines the approval process and ensures compliance with lending regulations.

Understanding the Authorization Process

Understanding the authorization process for student loans is essential to ensure timely approval and access to funds. Proper documentation verifies eligibility and supports the loan application effectively.

- Proof of Identity - Valid government-issued identification such as a passport or driver's license is required to confirm the borrower's identity.

- Enrollment Verification - An official document from the educational institution confirming the student's enrollment status and course details.

- Financial Information - Recent income statements or tax returns demonstrating the borrower's or co-signer's ability to repay the loan.

Key Eligibility Criteria for Student Loans

To obtain student loan authorization, applicants must present proof of enrollment in an accredited institution and a valid government-issued identification document. Key eligibility criteria include demonstrating financial need, having a satisfactory credit history or a co-signer if required, and meeting residency or citizenship requirements set by the lender. Supporting documents such as income statements, tax returns, and loan application forms are also necessary to verify eligibility and facilitate processing.

Essential Documents Required for Authorization

Obtaining student loan authorization requires submitting specific documents to verify identity, enrollment, and financial status. These essential documents ensure a smooth and compliant loan approval process.

- Proof of Identity - A government-issued ID like a passport or driver's license confirms your identity for the loan application.

- Enrollment Verification - A certificate from your educational institution verifies your current student status and eligibility for the loan.

- Financial Documentation - Recent tax returns or income statements demonstrate your financial situation to assess loan repayment capability.

Step-by-Step Application Process

| Step | Required Documents | Description |

|---|---|---|

| 1. Identity Verification | Government-issued ID (Passport, Driver's License) | Confirm your identity with official documents to start the application. |

| 2. Proof of Enrollment | Admission Letter, Enrollment Certificate | Submit documents verifying current or accepted student status at an accredited institution. |

| 3. Financial Information | Income Statements, Tax Returns, Bank Statements | Provide proof of income and financial status to determine loan eligibility and amount. |

| 4. Credit History Documents | Credit Report (if applicable) | Some lenders require a credit report to assess the risk for authorization. |

| 5. Loan Application Form | Completed and Signed Loan Application | Fill out necessary forms with accurate personal, academic, and financial details. |

| 6. Co-signer Documents (if necessary) | Co-signer's ID, Income Proof | When required, submit a co-signer's identification and financial proof to support loan approval. |

| 7. Additional Supporting Documents | Residency Proof, Letter of Explanation | Submit any extra documentation requested by the lender to clarify or support your application. |

Common Mistakes to Avoid in Documentation

To secure student loan authorization, submitting accurate and complete documentation is crucial. Essential documents typically include proof of identity, enrollment confirmation, and financial statements.

Common mistakes to avoid include submitting expired identification or incomplete enrollment verification. Ensuring all documents are current and fully detailed minimizes delays in authorization processing.

Verification and Approval Procedures

Student loan authorization requires submitting essential verification documents such as proof of enrollment, identity verification, and financial information. These documents ensure the borrower's eligibility and enable accurate assessment of loan terms.

Loan approval procedures include a thorough review of academic status, credit history, and income verification. Lenders may request additional paperwork or conduct interviews to validate the provided information before final authorization.

Timelines and Expected Processing Duration

Student loan authorization requires several key documents, including proof of identity, enrollment verification, and financial statements. Timely submission of these documents is critical to ensure smooth processing.

Typically, the authorization process can take between 2 to 6 weeks depending on the lender and completeness of documentation. Enrollment verification must be up-to-date, often needing confirmation at the start of each academic term. Missing or incomplete paperwork can cause significant delays, extending the processing period by several weeks.

Frequently Asked Questions on Authorization

Student loan authorization requires specific documents to verify identity, eligibility, and financial status. Understanding these documents helps streamline the approval process.

- Proof of Identity - Government-issued ID such as a passport or driver's license to confirm the borrower's identity.

- Admission Letter - Official acceptance letter from the educational institution to validate enrollment.

- Income Statements - Recent pay stubs or tax returns to assess financial capability and repayment ability.

Providing accurate and complete documentation ensures timely authorization of student loans.

What Documents are Necessary for Student Loan Authorization? Infographic